The top five banks had a combined second-lien loan volume of more than $95 billion at the end of December 2024.

Lenders are brushing up on ways to minimize losses associated with the increasing costs to fund mortgage pipelines.

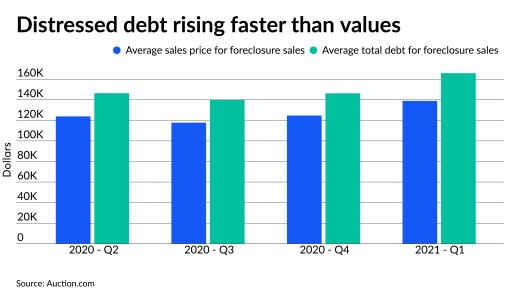

The sooner troubled loans can be put on a more proactive servicing path, the more likely the distressed homeowners will be able to avoid foreclosure, writes the vice president of market economics at Auction.com.

By a 2-1 vote, a three-judge panel of the D.C. Circuit Court of Appeals ruled that the CFPB's union did not have a reviewable claim under the Administrative Procedure Act. The union is expected to appeal to the full D.C. Circuit.

The real estate company said it started the search for a new CEO mid-year following Carrie Wheeler's notice to the board she was looking to leave.

-

Besides the investment, Citi was also the sole bookrunner on Vontive's first-ever securitization, made up of $150 million of residential transition loans.

-

The company anticipates a $139.8 million contingency liability and nearly $60 million related expense in a court battle with Pine River Capital Management.

-

The regulator has postponed the building code in question, but is otherwise battling the challenge raised during the Biden administration.

-

Uncover the key reasons why lenders should care about liner failures and how environmental risks can derail loan performance when ignored during review.

-

Rocket Companies and Mesa have both launched credit cards geared that offer homeowners perks and points for paying their mortgage and buying housing-related items.

-

Proprietary reverse loans are typically available to a larger range of borrowers and come with higher loan limits than the Home Equity Conversion Mortgage.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

We're hearing a lot about the upcoming NFL season, with the first real games right around the corner.

-

It is important for borrowers to shop around and find out whether an adjustable or fixed rate mortgage best fits their needs.

-

Is the Consumer Financial Protection Bureau taking a page from the NCAA?

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland