Property inspection waivers were granted on 40.2% of the underlying mortgages, reflecting an increasing trend of agency mortgages being originated without them.

Tri-merge mandates prop up a credit bureau/FICO oligopoly, raising mortgage costs with little benefit despite risk concerns, the chairman of Whalen Global Advisors argues.

Foreclosure filings were reported on more than 360,000 properties in the United States last year, up 14% from 2025 and 3% from 2023, according to Attom.

Pulte says a GSE stock offering remains likely in 2026, but other policy paths are in play. NMN survey data shows the industry expects broader changes first.

WomenVenture, a Minneapolis-based Community Development Financial Institution, was already under strain from stalled federal CDFI funding. The recent immigration crackdown added significant uncertainty for its customers as well.

-

Lennar Corp. and Taylor Morrison Home Corp. are among the firms that have worked on the proposal, which calls for builders to sell entry-level homes into a pathway-to-ownership program funded by private investors, according to people familiar with the plan.

-

Jonathan Yasko pleaded guilty to diverting monies in real estate transactions to cover unrelated closings, and to pay for his own cars and personal travel.

-

Bed Bath & Beyond purchased Tokens.com, a blockchain platform utilizing services from Figure, tZERO and ShyftLabs.

-

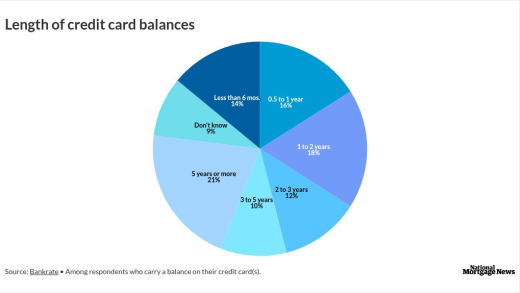

President Donald Trump's support of legislation that would cap credit card interest rates at 10% has flagged in recent weeks, but experts say that the debate has highlighted significant gaps in regulators' understanding of the credit card market and how its risks are priced.

-

The National Consumer Law Center is claiming the Credit Data Industry Association wants to suppress Consumer Financial Protection Bureau complaint filings.

-

The SEC named Demetrios "Jim" Logothetis as chairman of the PCAOB, and Mark Calabria, Kyle Hauptman and Steven Laughton as board members.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Several claims in a recent Loan Think column misrepresented how credit scores and resellers work in mortgage lending, according to the president of the National Consumer Reporting Association.

-

Renters who pay on time deserve credit toward homeownership, and new data tools can make that possible, according to the owner of Burkentine Real Estate Group.

-

In order to believe in the idea of "competition" in credit scores, the Washington housing community must believe that large institutional investors who buy whole loans and mortgage-backed securities are really, really dumb, writes the Chairman of Whalen Global Advisors

Leadership across all financial services was more likely to see a significant skills gap in today's workforce compared to the mortgage industry, according to Arizent's research.

While the rise of artificial intelligence in home lending brings about "fascination" over its capabilities for some, others claim it's a technology people might use "to mask their incompetence."

- ON-DEMAND VIDEO

Cybersecurity incidents at vendors often expose their business partners to significant risk. What are the threats lenders face, and how can they strengthen their defenses?

- ON-DEMAND VIDEO

Gary Quinzel, vice president of portfolio consulting at Wealth Enhancement Group, gives his views about monetary policy and offers his opinion on the FOMC statement and Fed Chair Jerome Powell's press conference.

- ON-DEMAND VIDEO

Escalating unaffordability is not the only issue originators face. How can lenders support their loan officers, and navigate the numerous challenges in the today's housing market?