Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

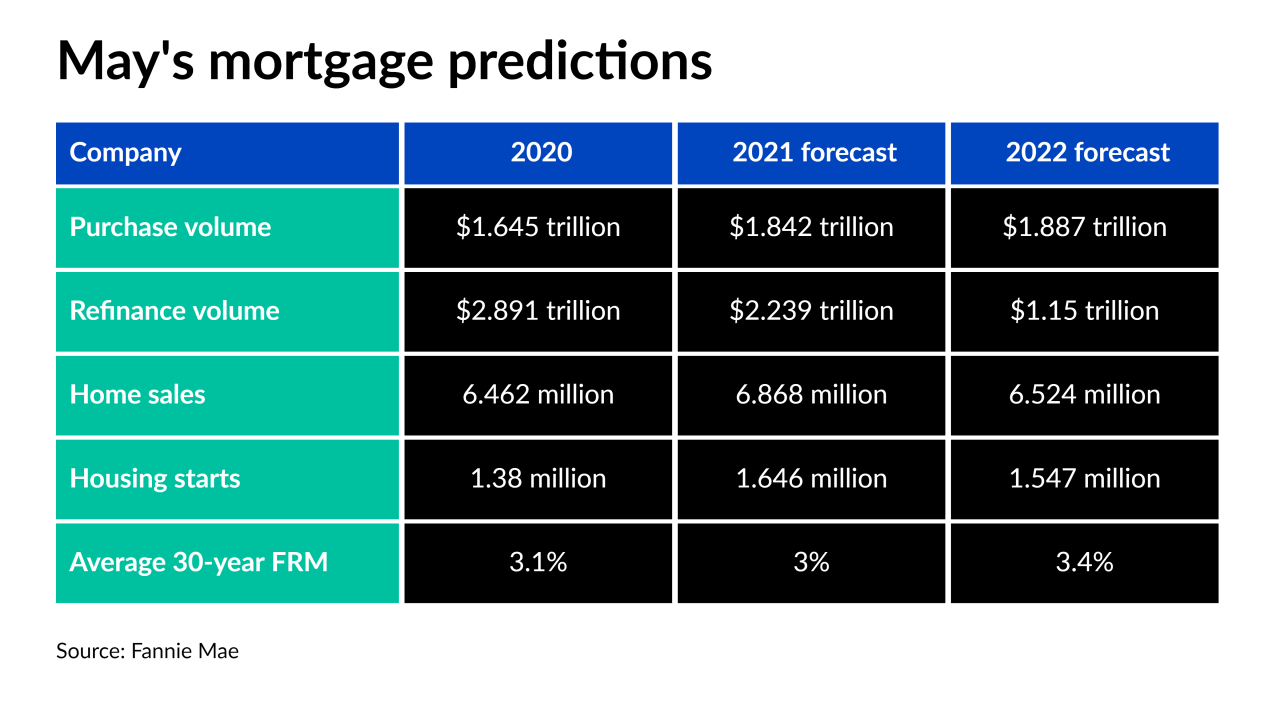

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Mortgage activity fell across the board despite analysis that 14.5 million current qualified borrowers would benefit from a refinance, according to Black Knight.

May 17 -

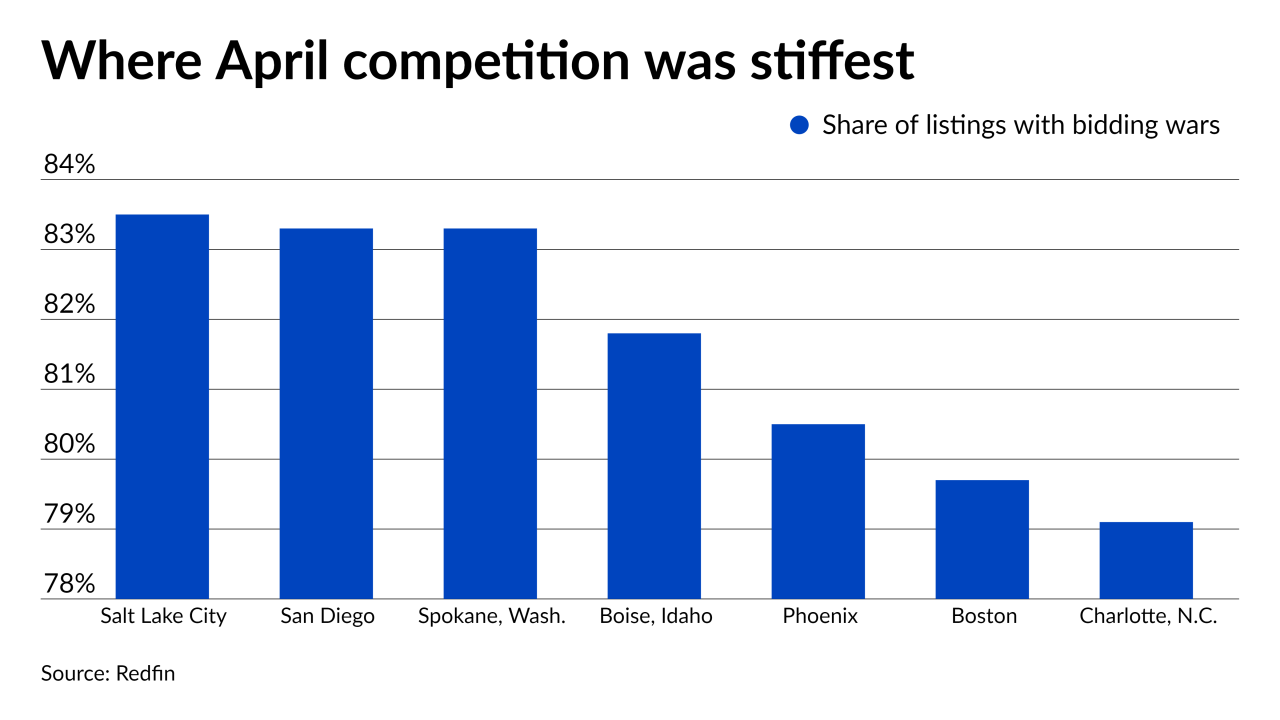

Homebuyer competition reached new heights right as the purchase market hits its busiest time of year, according to Redfin.

May 14 -

While COVID-19 pushed digitization to the forefront of lending, a majority of borrowers still want some degree of human interaction, according to a survey by ICE Mortgage Technology.

May 13 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

After massive fundraises and IPO rumors swirled, the originator and servicer announced it will merge with Aurora Acquisition Corp. and go public in the fourth quarter of 2021.

May 11 -

Altisource Portfolio Solutions’ bottom line took a larger hit in the first quarter compared to Q4 2020, causing the company to cut costs.

May 10 -

In spite of an improving economy, acute competition and supply scarcity soured homeshoppers on the purchase market in April, according to Fannie Mae.

May 7 -

The defendants face 133 felony counts that include allegedly stealing identities to commit mortgage fraud between 2014 and 2020, resulting in the theft of $15 million.

May 7 -

While cash-out refinances were a “significant driver” of risky loans leading to the Great Recession, those mortgages pose less of a threat due to tighter underwriting standards, according to Milliman.

May 5 -

Residential value growth in March reached heights not seen since the lead up to the housing bubble, according to CoreLogic.

May 4 -

An economic rebound, stimulus payments and COVID-19 vaccinations contributed to new delinquencies dropping to an all-time monthly low with more recovery ahead, according to Black Knight.

May 3 -

As consumers search for homebuying advantages, local lenders discuss the 12 metro areas where it’s more affordable to purchase a property rather than rent a comparable house, according to Realtor.com data.

April 30 -

Depressed Treasury yields have kept mortgage rates under 3% recently, but positive economic news could indicate larger increases will follow this week’s uptick.

April 29 -

After a one-week reprieve, mortgage activity waned again with decreased demand for refinances and extremely low inventory for homebuyers.

April 28 -

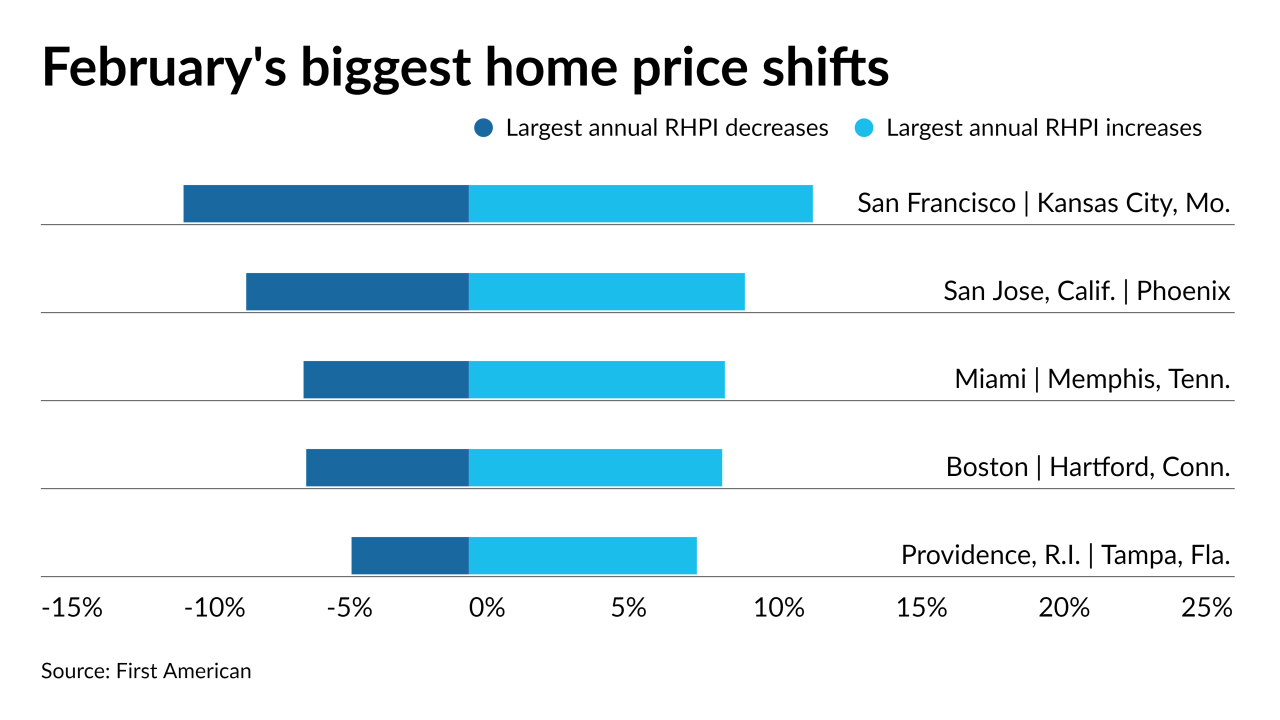

Despite home purchasing power growing for the 14th consecutive month in February, rising property values and mortgage rates are likely to influence would-be sellers to stay put, according to First American.

April 27 -

Despite falling from quarter to quarter, Flagstar’s mortgage revenues remained strong, while its servicing portfolio grew.

April 26 -

While government protections currently shield most borrowers and delay process timelines, a growing backlog is likely to hit some areas of the country worse than others.

April 23 -

While it’s the third straight week of a downward trend, borrowers likely have only a brief opportunity to take advantage of sub-3% rates before a reversal comes.

April 22 -

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21