Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

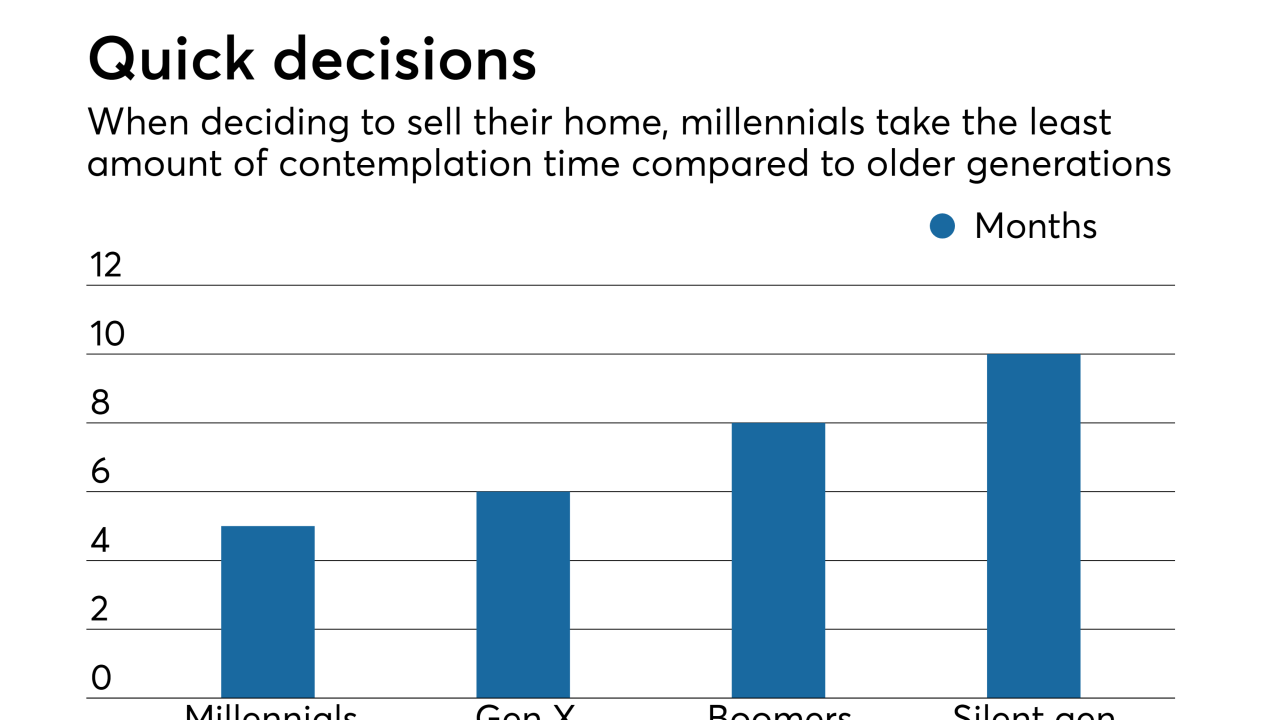

Millennials make up the largest constituent group for both homebuyers and sellers, which could put a squeeze on lending and eventually shift the market.

September 28 -

As home prices continue to rise, a record-high 77% of people surveyed think it's currently a strong time to sell a house, according to the National Association of Realtors.

September 26 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24 -

As mortgage rates jump and housing inventory rises, over a quarter of all home listings dropped their price in the past month, according to Redfin.

September 21 -

Mortgage rates increased 5 basis points this week, up for the fourth week in a row with momentum building for further hikes, according to Freddie Mac.

September 20 -

As mortgage rates remained mostly tepid throughout the summer, closed refinances had their first month of growth in August, according to Ellie Mae.

September 19 -

More buyers could be in the market for new homes as housing authorizations and maintenance volume increased while remodels fell, according to BuildFax.

September 18 -

While new-home construction and sales should rise in the next 18 months, next year's mortgage origination volume estimate was cut slightly as the economy is expected to slow down soon, said Fannie Mae.

September 17 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14 -

Mortgage origination volume continues to decline as homebuyers receiving loans bring more money to the closing table.

September 13 -

Staggering home prices and steep tax rates are pushing people from expensive cities along the coasts to more affordable locales.

September 12 -

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

September 11 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

From origination to servicing and everything in between, here's a sneak peek at the companies and products presenting demos at the 2018 Digital Mortgage Conference.

September 10 -

The typical homeowner spends 17.5% of their income on monthly mortgage payments, according to Zillow's second quarter affordability report.

September 6 -

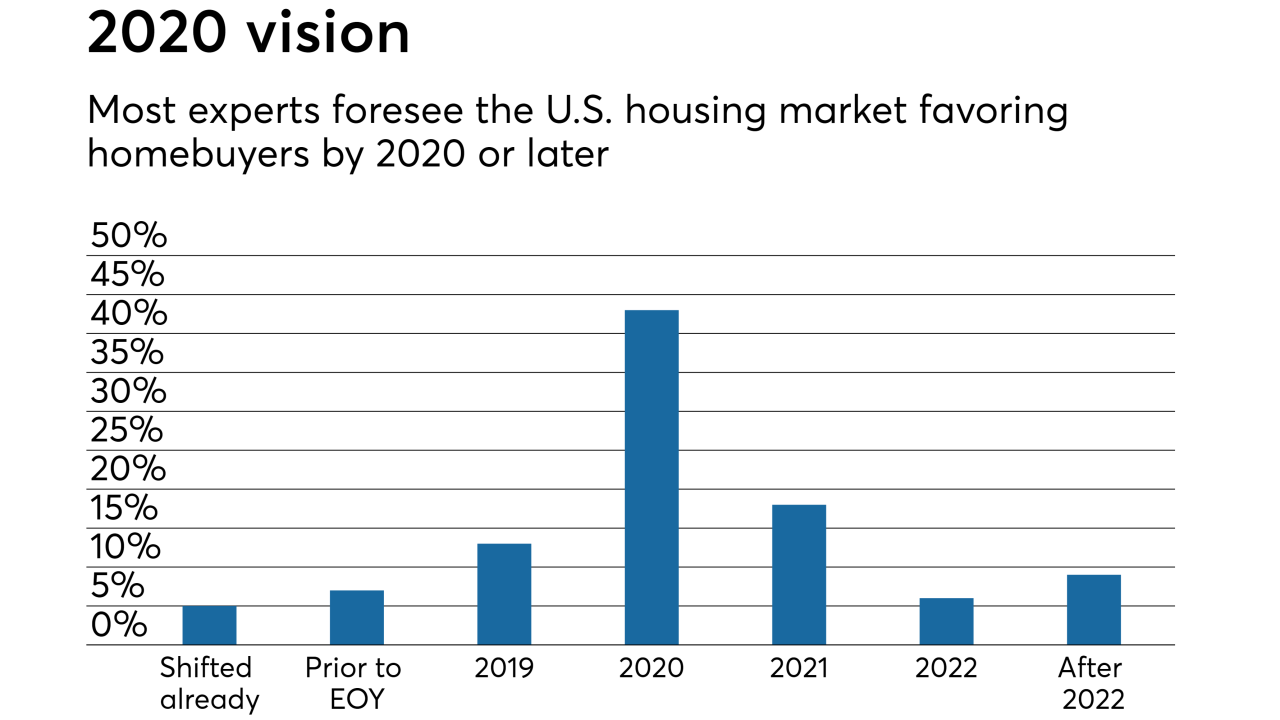

After home prices soared due to a lack of inventory and a recovering economy, three-quarters of experts believe the shift to a buyer's housing market should come in two years.

September 5 -

Growth in home prices remained churning at a steady pace, with sellers holding out for better returns and suppressing the supply of available housing.

September 4 -

New Jersey Governor Phil Murphy signed a bill to revise the state's Residential Mortgage Lending Act to facilitate transitional licensing for loan officers and to streamline the law's provisions for borrower fees.

August 31