-

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

March 12 -

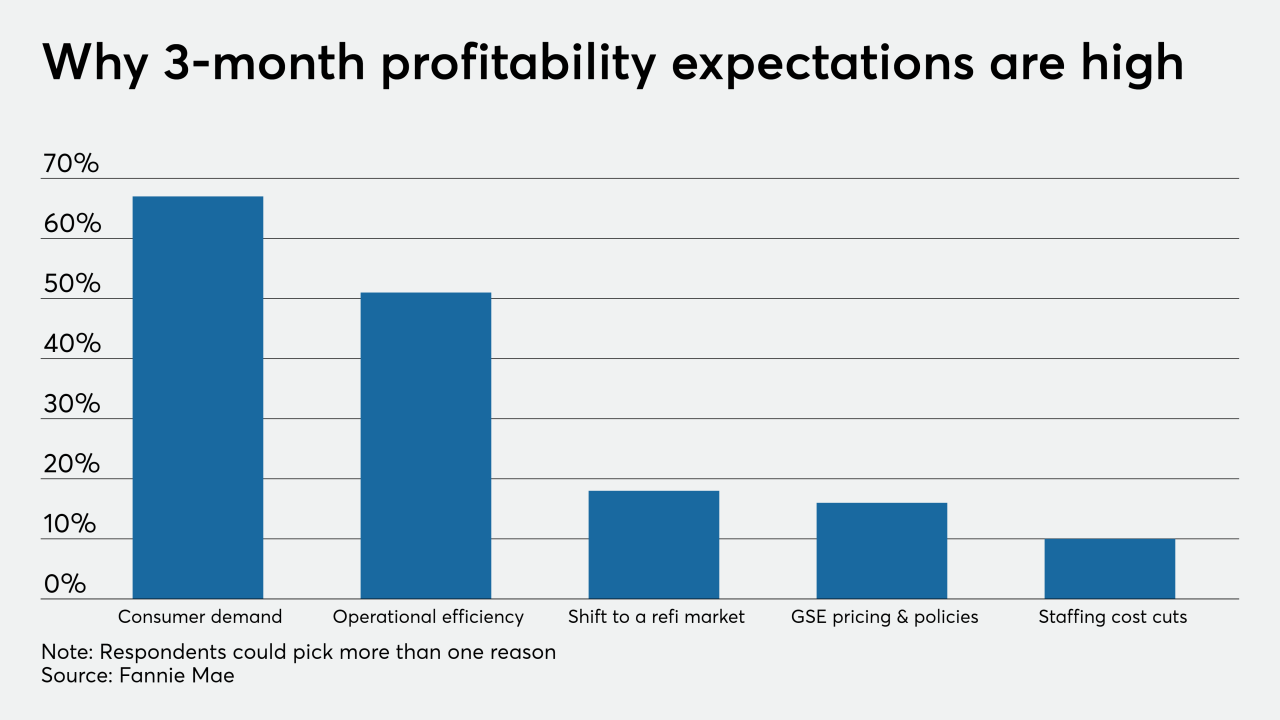

Companies in the mortgage business were already focused on processing a lot of loans and generating efficiencies before the latest uptick in business hit.

March 12 -

Houston-area home sales experienced another double-digit gain in February as buyers came out in droves to take advantage of low mortgage rates.

March 12 -

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

March 12 -

With the return of volume and profitability to mortgage lending, it is no surprise that commercial banks are coming back to the market.

March 11 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Buying a home became slightly more attractive compared to renting in the fourth quarter, as the likelihood of another huge value drop decreased, an index from two Florida universities found.

March 11 -

While clients are uneasy about the spread of coronavirus, Kelly King touted the added volume his company has seen from lower rates.

March 10 -

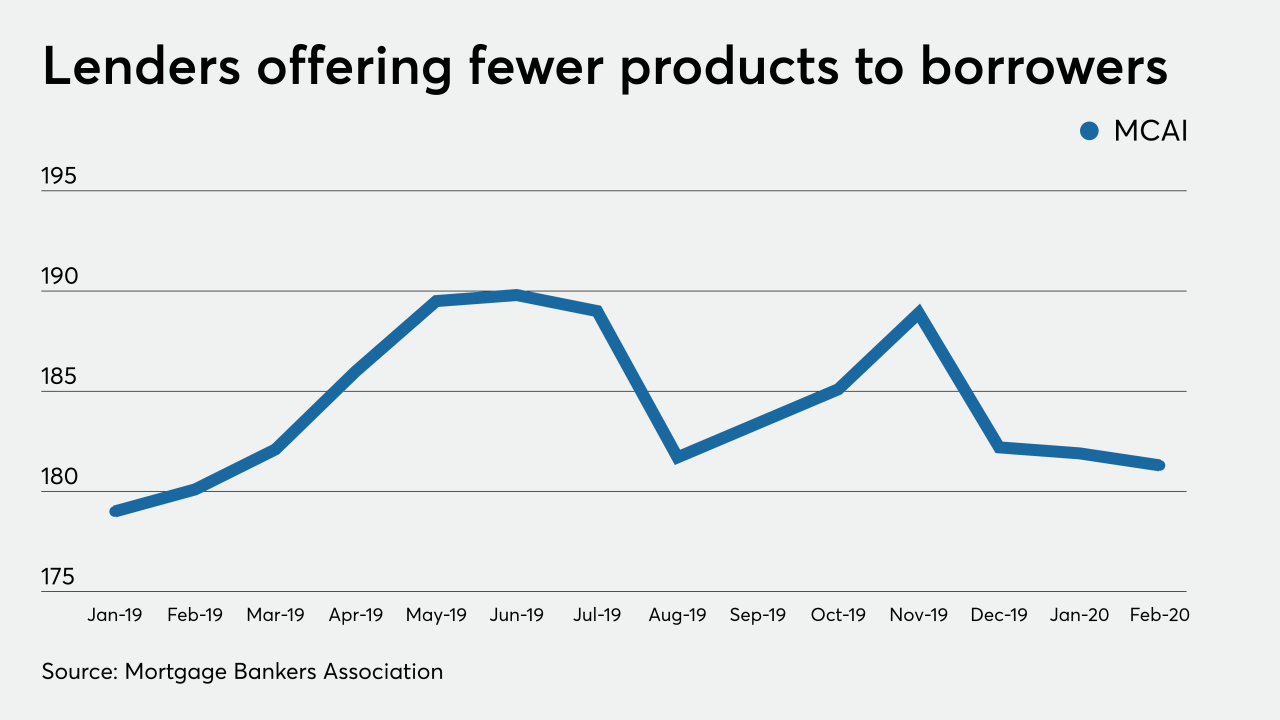

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

March 9 -

Consumer sentiment for home buying stayed near its record high behind low mortgage rates and a strong job market, though the declining stock markets and COVID-19 concerns may change that soon, according to Fannie Mae.

March 9 -

From credit unions to banks, loan officers in South Florida are on the phones with homeowners, many of whom have one question: When can I refinance my mortgage?

March 9 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

Mortgage rates, which fell to a 50-year low last week, are keeping Oahu's real estate market relatively strong even as uncertainties mount over the economic impacts of coronavirus outbreaks.

March 9 -

The 10-year Treasury yield fell below 0.5% and the 30-year yield dropped under 0.9%, taking the whole U.S. yield curve below 1% for the first time in history.

March 9 -

It's hard to overstate just how wild bond markets have gotten amid the coronavirus scare, forcing traders to rethink what's possible.

March 6 -

Mortgage interest rates dropped this week to the lowest level on record, fueling an already hot spring housing market and triggering a refinance boom in the Twin Cities.

March 6 -

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.

March 6 -

Capacity constraints among mortgage lenders are leading to wider spreads between mortgages and the 10-year Treasury yield even after it remained below 1% for an extended period this week.

March 5 -

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

Endorsements of Home Equity Conversion Mortgages fell nearly 14% on a consecutive-month basis in February after a January surge, but stayed relatively strong compared to average levels last year.

March 5