-

Still, the average time a property is on the market is at an all-time low, with more than half going into contract within two weeks.

July 9 -

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

While purchasing power grew for the 16th straight month in April, surging property values and increased mortgage rate forecasts will keep driving down affordability, according to First American.

June 28 -

Median home prices are higher than the historical average in 61% of U.S. counties, Attom Data Solutions said, and it's unclear if the situation gets better or worse.

June 24 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

A week of light data could possibly lead to further mortgage-rate volatility ahead depending on what monetary officials say in the coming days.

May 20 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

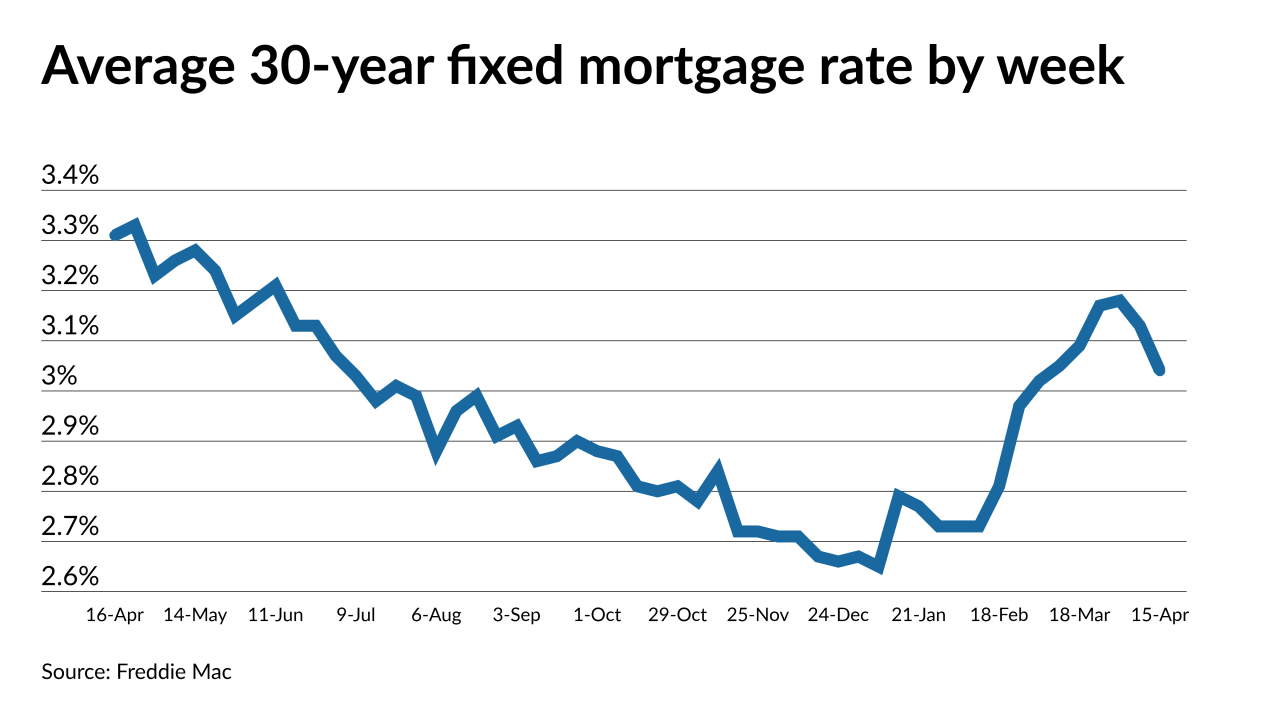

Inflation concerns may reverse the trend that has seen the 30-year rate decline six out of the last seven weeks.

May 13 -

In spite of an improving economy, acute competition and supply scarcity soured homeshoppers on the purchase market in April, according to Fannie Mae.

May 7 -

Promising jobs numbers and favorable economic data are an encouraging sign for the post-pandemic future, but rising interest rates are sure to follow.

May 6 -

Depressed Treasury yields have kept mortgage rates under 3% recently, but positive economic news could indicate larger increases will follow this week’s uptick.

April 29 -

Inflation, an improving economy and the increased federal budget deficit make rate increase inevitable this year, the Mortgage Bankers Association said.

April 22 -

While it’s the third straight week of a downward trend, borrowers likely have only a brief opportunity to take advantage of sub-3% rates before a reversal comes.

April 22 -

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

Vaccinations and a third round of stimulus payments are boosting consumers views on the housing market, according to Fannie Mae.

April 7 -

After two straight months on an upward trajectory, rising interest rates pushed homebuyer demand down to a third of where it stood at the start of 2021, according to Freddie Mac.

April 1 -

But the 10-year Treasury yield began backing down after the weekend as investors reacted to turmoil in Europe.

March 25 -

From offering operations folks big bonuses to grooming recent grads, lenders are getting creative in their efforts to manage staffing throughout the boom-bust cycle.

March 22 -

However, the increase has been more gradual than that seen in Treasury yields, and loan activity has only subsided slightly to date.

March 18