-

The notes are backed by $456.9 million in high-balance loans that meet qualified mortgage standards, according to ratings agency presale reports.

October 5 -

Kroll's $2 million settlement with the SEC over failing to adhere to credit-rating standards for CMBS and CLO bonds are fueling concerns that rosy credit grades are masking deeper structural problems with the securities exposed by COVID-19 related stresses, say critics.

October 5 -

Two more lenders, AmeriHome and Caliber, look to join Rocket and United Wholesale Mortgage, by raising capital through public stock offerings.

October 2 -

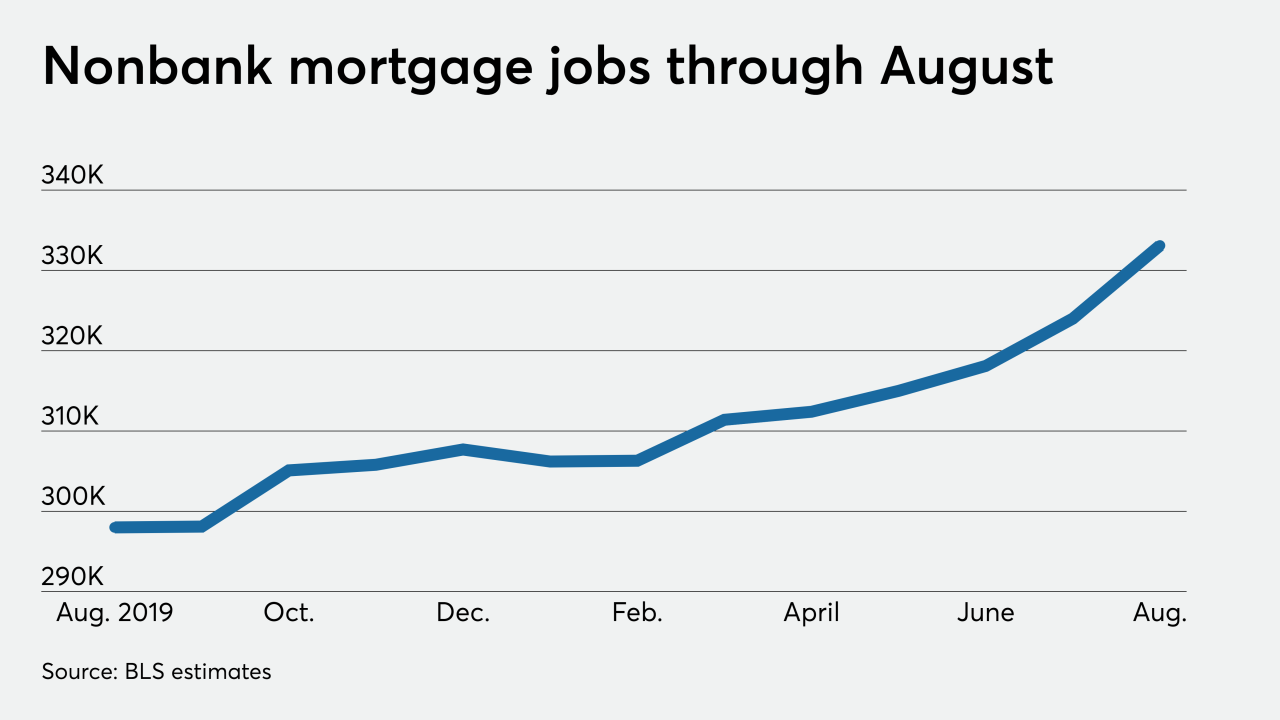

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

Kathy Kraninger’s job status would be in question if Joe Biden wins the White House. If the president is reelected, she may continue balancing a deregulatory agenda with her unexpectedly tough stance on enforcement.

October 2 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

Control of the U.S. Senate hangs in the balance in the upcoming election, with the outcome determining the direction of laws and regulations that can have a profound impact on financial services, technology, fintech and payments innovation.

October 2 -

With the onset of COVID and the reaction by the Federal Reserve Board and other agencies, market pressures have reduced credit availability significantly.

October 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The bar to prove discriminatory patterns is so high that plaintiffs would have slim odds of winning lawsuits against housing providers.

October 2 George Washington University

George Washington University -

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

October 1 -

The bureau released a five-year review of the so-called TRID regulation that found consumers benefited from being able to compare mortgage terms and costs, but the price tag for the industry was roughly $146 per loan.

October 1 -

Customers suffered when they were placed in mortgage relief plans without their consent, the Massachusetts senator says. She urged the Federal Reserve to take the blunder into account as it weighs when to lift other sanctions against the bank.

October 1 -

The government-sponsored enterprise's first multifamily sustainability bond transaction, totaling $600 million, is part of Freddie's K-Deal program.

October 1 -

The proposed best practices would be modeled after federal servicing standards and be used to supervise nonbanks firms subject to state regimes.

October 1 -

China Oceanwide said it was not able to meet with Hony Capital to finalize the terms and conditions because of the pandemic.

October 1 -

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

October 1 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

Student housing and assisted/independent living centers were small portions of Freddie's multifamily securitizations prior to COVID, but Kroll noticed they've been missing in most rated deals since spring.

September 30 -

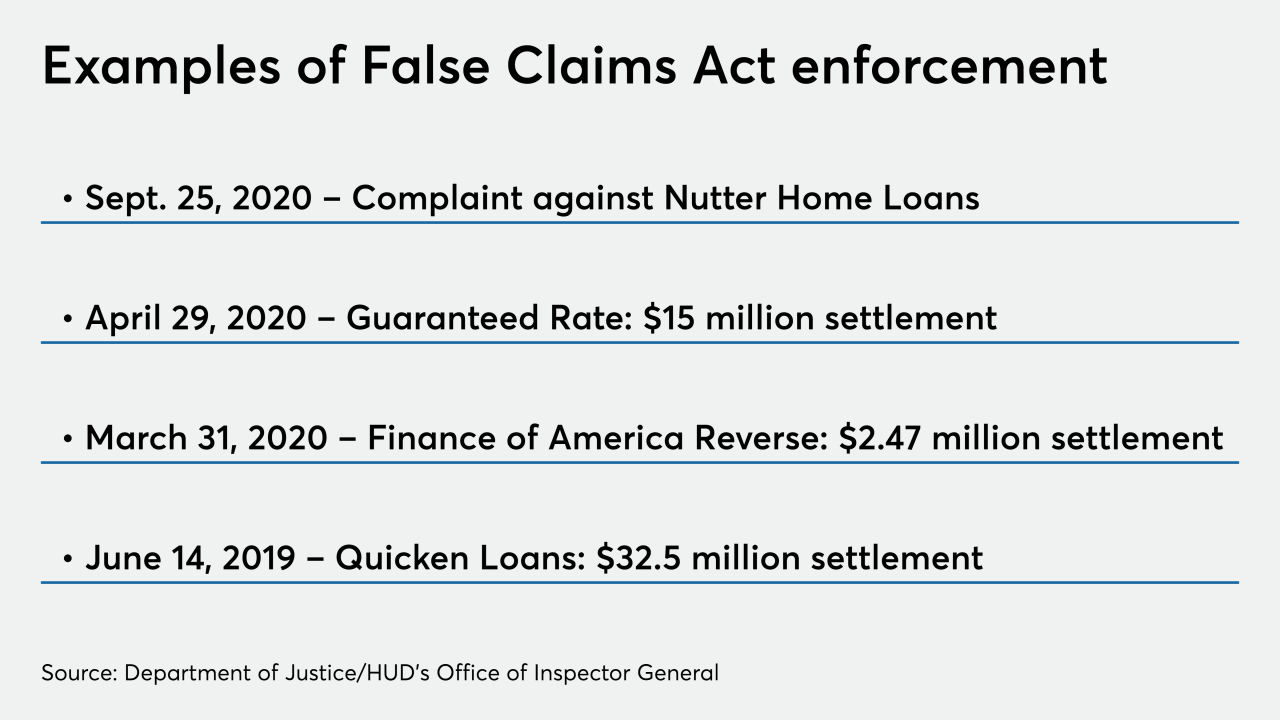

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

Pending home sales rose more than expected in August, reaching the highest level on record as low mortgage rates fuel a housing rally.

September 30