-

Sales of previously owned homes remained brisk in August as low mortgage rates and demand for space in the suburbs sustained strength in a housing market that’s a bright spot for the economy.

September 22 -

The percentage of borrowers who have asked to temporarily suspend payments due to coronavirus-related hardships is down overall, but in the Ginnie Mae market, they're still inching up.

September 21 -

Shannon King, a single mother, left the Bay Area a decade ago as housing costs soared, hoping to find an affordable place to live in southern Oregon.

September 21 -

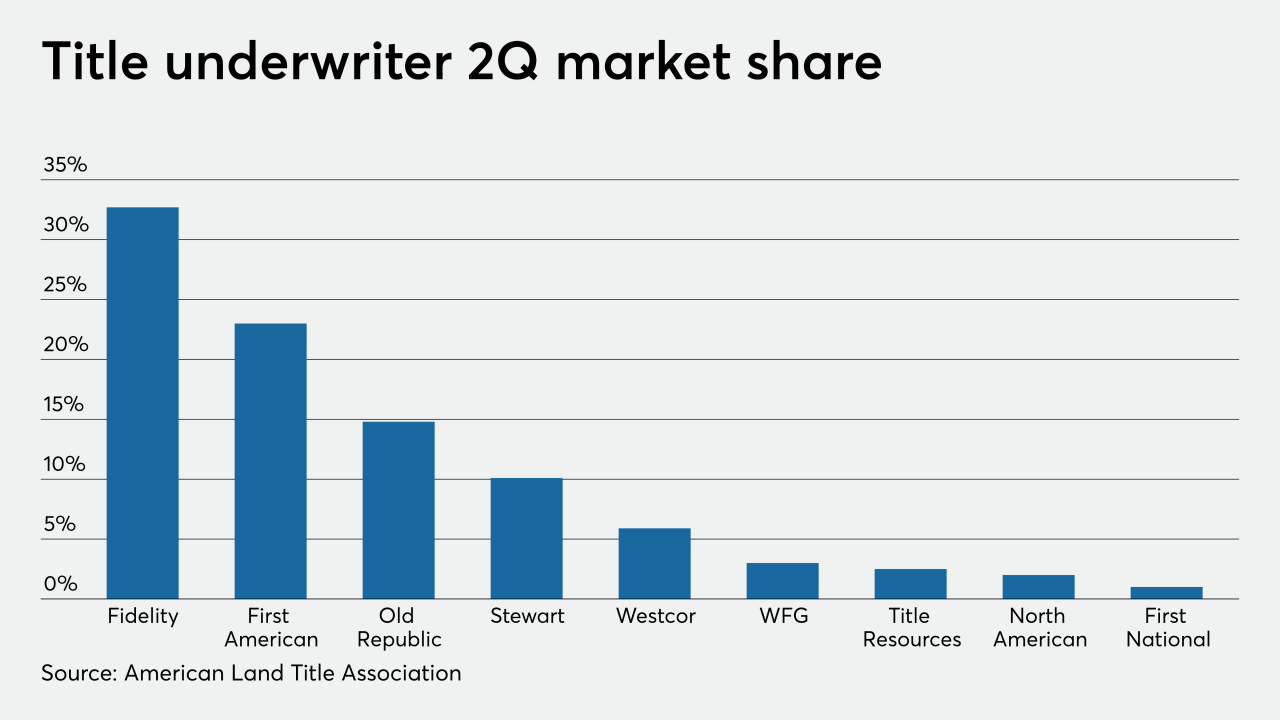

Westcor has been gaining market share, growing to 5.9% of premiums written in 2Q 2020, versus 3.4% in the first quarter of 2019.

September 21 - LIBOR

The restrictions on the pooling of loans with any interest term based on Libor will be effective for traditional mortgage-backed securities issued starting Jan. 21, 2021, and earlier for reverse-mortgage securitizations.

September 21 -

More defaults will lead to an increase in distressed sales, and that will drive down prices, CoreLogic said.

September 21 -

A conversation with Greg Carmichael, Chairman, President and Chief Executive Officer, Fifth Third Bancorp discussing the consumer banking trends and lessons learned during the pandemic.

-

Taylor, Bean & Whitaker's former chairman and CEO, Lee Farkas, led a $2.9 billion mortgage fraud scheme during the housing crash but was released early from prison due to susceptibility of COVID-19 transmission.

September 18 -

Bondholders could see principal losses if, due to the way the documents are worded, the rate is frozen at the last published amount.

September 18 -

Remote, homeowner-assisted appraisals used amid the coronavirus could be a useful tool post-pandemic, in limited circumstances.

September 18 -

Measures designed to give banks and credit unions more flexibility to help customers weather the coronavirus pandemic are set to expire Dec. 31 unless Congress renews them.

September 18 -

A combination of pent-up demand, low inventory and rock bottom interest rates is making it extra tough for homebuyers with government-backed loans.

September 18 -

The future of Fannie Mae and Freddie Mac, the Fed’s supervisory regime for the biggest financial institutions, reform of the Community Reinvestment Act and a host of other industry-related issues are on the ballot this November.

September 17 -

The Flagstar MortgageTech Accelerator program was designed to give qualified fintechs access to experienced mentors and potential customers. Applicants also may obtain access to seed capital funding.

September 17 -

Mortgage lender loanDepot is taking steps toward rebooting plans for an initial public offering, about five years after scrapping one at the last minute, according to people with knowledge of the matter.

September 17 -

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

September 17 -

Nowhere is the widening gap between real estate and the real economy more apparent than in Las Vegas, where tourism is in ruins, wages are plunging and home prices just keep rocketing higher.

September 17 -

Fannie Mae and Freddie Mac have been slammed for planning an additional refinancing charge to cover COVID-related losses, but the head of the Federal Housing Finance Agency defended the policy in House testimony.

September 16 -

Low rates, along with increased new and existing home sales activity drives the latest forecast.

September 16 -

The central bank said it would keep interest rates at current levels through at least to help the U.S. economy recover from the coronavirus pandemic.

September 16