-

Some lawmakers fear that when forbearance plans and enhanced unemployment coverage expire, the consequences for mortgage borrowers still affected by the pandemic will be severe.

June 9 -

Looming economic uncertainties forced mortgage lenders to tighten underwriting standards in May.

June 9 -

A federal grand jury indicted Ronald J. McCord, 69, of Oklahoma City, on charges of defrauding two banks, Fannie Mae, and others of millions of dollars, money laundering, and making a false statement to a financial institution, said Timothy J. Downing, U.S. attorney for the Western District of Oklahoma.

June 9 -

The FHFA’s proposal is intended to strengthen Fannie Mae and Freddie Mac, but many experts warn that it could boost guarantee fees for lenders that they say may be passed on to borrowers.

June 8 -

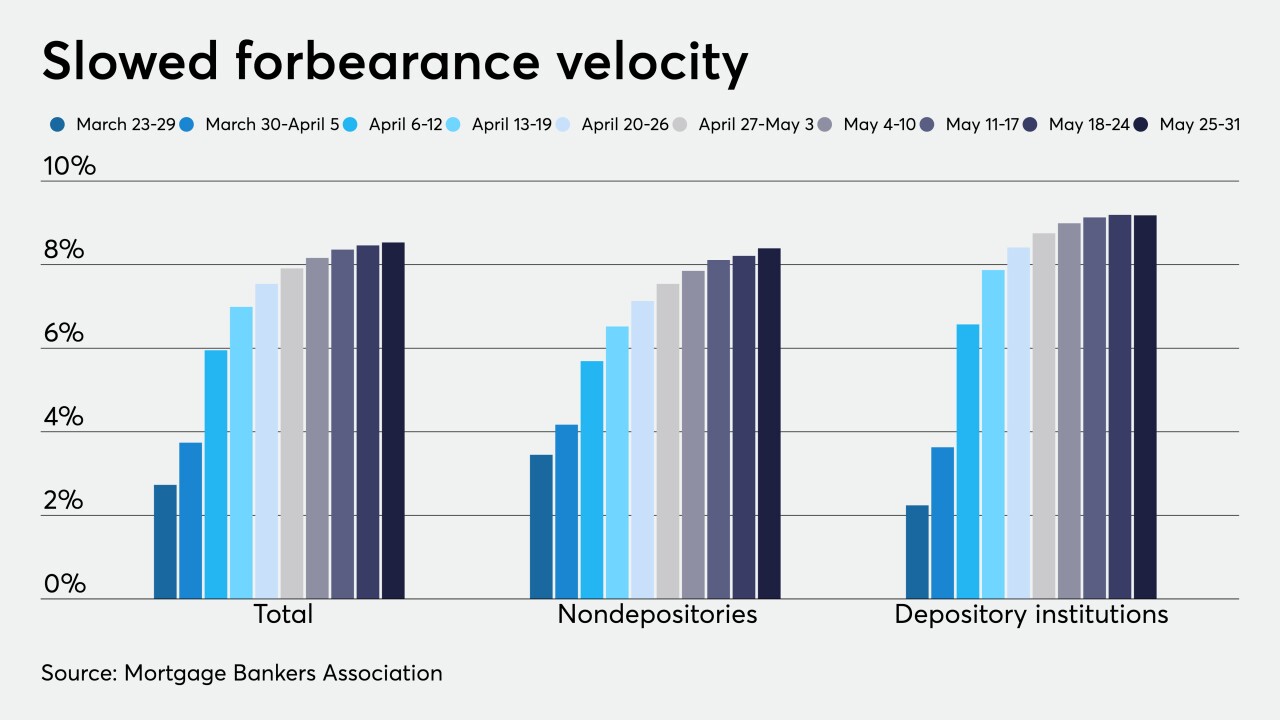

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

After bottoming out at a 10-year low in April, consumer sentiment for home buying rebounded in May, according to Fannie Mae.

June 8 -

About 9% of government-insured loans in forbearance have low equity, which could hamper post-forbearance servicing.

June 8 -

Former Comptroller of the Currency Joseph Otting landed a post with Black Knight, which provides technology solutions to mortgage and real estate companies.

June 8 -

With the impacts of the coronavirus in full bore, housing market experts predict home prices to fall in 2020.

June 8 -

Hudson Americas is pooling its next aggregation of non-qualified, high-balance mortgages in a new securitization that is exposed to a large share of borrowers seeking or already receiving pandemic-related forbearance or deferral on payments. So far, a little over half of those granted the allowance have yet to skip any payments.

June 8 -

A $740 million jury verdict against Amrock was thrown out by a Texas appeals court that said tech firm HouseCanary failed to prove the big title insurer stole its trade secrets to build a competing real estate analysis tool.

June 5 -

But there was an increase in private-label mortgages in forbearance.

June 5 -

Nonbank mortgage hiring inched down when overall employment plunged in April. The subsequent recovery in overall jobs suggests the housing-finance industry is still bearing up well despite coronavirus-related strain.

June 5 -

Mortgage industry hiring and new job appointments for the week ending June 5.

June 5 -

One criticism of the CARES Act is that it provides relief only to borrowers with government-backed loans. Bills in New York and California would cover the remaining 30% of homeowners.

June 4 -

Independent mortgage banks started 2020 strong after three quarters of high profits, according to the Mortgage Bankers Association.

June 4 -

The policy comes more than a month after a different agency issued similar guidance for loans backed by Fannie Mae and Freddie Mac.

June 4 -

The Consumer Financial Protection Bureau seeks to address challenged posed by the sunset of the London interbank offered rate at the end of 2021.

June 4 -

Mortgage rates increased slightly this week as indicators point to an economic revival, including increased home sales activity, according to Freddie Mac.

June 4 -

Nine years of annual home price gains are expected to come to an end by next April, according to CoreLogic, although prices in Southern California are projected to continue rising.

June 4