-

Ginnie Mae is giving expanded loan buyout authority to certain issuers in order to help them remove loans affected by Hurricanes Irma and Harvey from securitized mortgage pools.

September 26 -

In a new book, Mehrsa Baradaran argues that the same forces of poverty that African-American banks were supposed to alleviate are now holding them back.

September 25 -

Mortgage delinquencies in areas affected by Hurricane Harvey last month were 16% higher than in July, according to Black Knight Financial Services.

September 21 -

Default rates for first-lien mortgages rose slightly higher in August and remain lower year-over-year, but recent hurricanes could intensify loan performance concerns.

September 20 -

The Equifax breach has millions of Americans now thinking about freezing their credit to guard against identity theft. But those who act could be cutting themselves off from the nation's vast credit economy.

September 19 -

Mortgage investors want Freddie Mac to align its policy with Fannie Mae's when it comes to how delinquencies related to Hurricane Harvey affect credit risk transfer deals.

September 19 -

Investor demand for mortgage bonds is strong; the only limiting factors are consumer awareness of the product and loan officers' willingness to offer them.

September 19 -

The online lender has accelerated its search for a permanent CEO and is said to be seeking someone with a history of success in banking.

September 15 -

Mike Cagney’s eventual successor will have to decide whether to continue his focus on rapid growth. Also on the table are strategic decisions about when to go public and whether to pursue a bank charter.

September 12 -

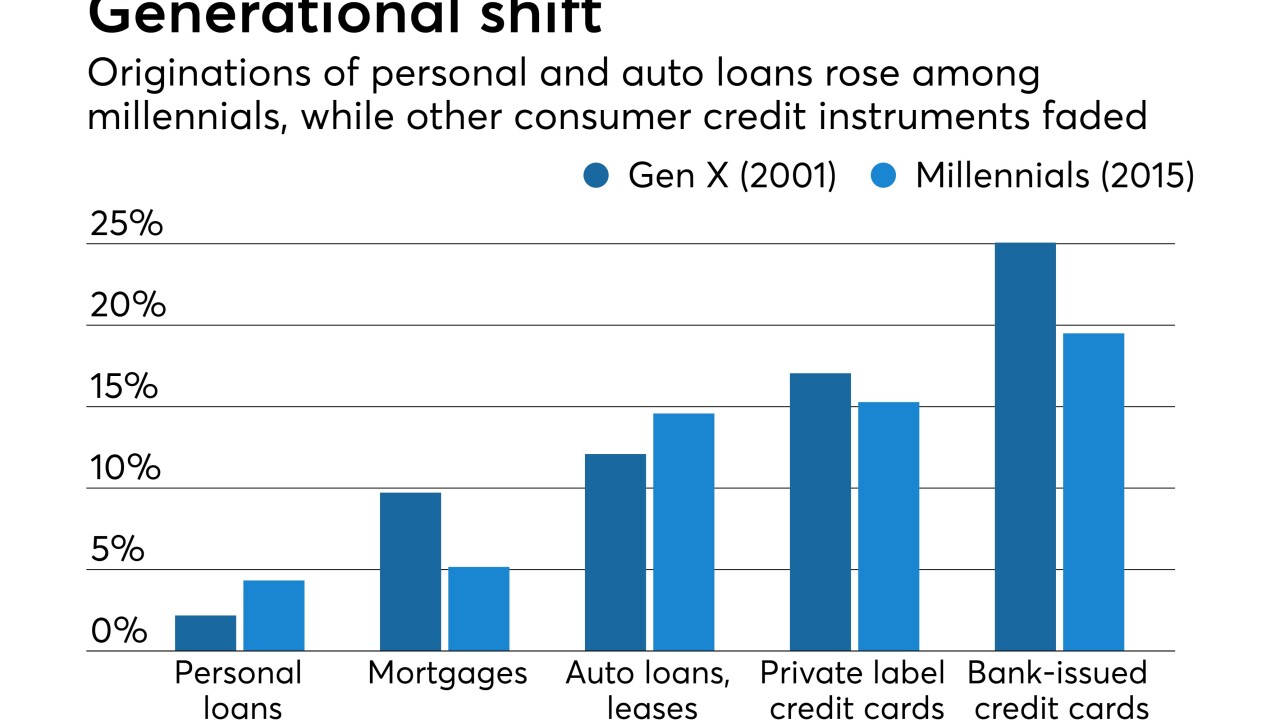

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

September 11 -

Over one-quarter of all mortgages in the areas affected by Hurricane Harvey are likely to become delinquent because of the storm, according to an analysis from Black Knight.

September 8 -

The $426.2 million COLT 2017-2 is backed entirely by loans originated by Caliber, an affiliate of private equity firm Lone Star Funds. There are no loans originated by Sterling Bank & Trust, which accounted for 22% of the collateral for the prior deal.

September 8 -

It’s highly debatable whether the artificial intelligence engines that online lenders typically use, and that banks are just starting to deploy, are capable of making credit decisions without inadvertent prejudices.

September 7 -

Given the scale of damage to the region’s homes and cars, bankers are guarding against an expected spike in missed payments by extending loan terms, deferring payments and making other concessions.

September 7 -

Ginnie Mae will help issuers with certain servicing obligations if more than 5% of their portfolios are in areas Hurricane Harvey has ravaged.

September 6 -

The largest generation of Americans is set to inherit over $59 trillion in assets, but the federal financial regulators are behind in hiring millennials and focusing on issues of concern to them.

August 31 Pickard, Djinis and Pisarri LLP

Pickard, Djinis and Pisarri LLP -

Consumer Financial Protection Bureau Director Richard Cordray said his possible political ambitions did not affect the small-dollar rule, while declining to spell out if he was running for office.

August 30 -

As Republicans policymakers pursue efforts to revamp the Consumer Financial Protection Bureau and replace its leadership, state agencies are already preparing to fill any vacuum that might ensue if the CFPB steps back.

August 30 -

House Financial Services Committee Chairman Jeb Hensarling, R-Texas, wrote a letter to CFPB Director Richard Cordray calling on him to clarify whether he is running for political office.

August 29 -

Republicans are already accusing CFPB Director Richard Cordray of misusing his job as a fundraising platform while many agency allies want him to stay.

August 25