-

Join Janet King, Arizent VP of Research and Brian Elkins, Senior Director of Strategy at Monigle for a discussion of a new, prescriptive framework that helps banks and other financial institutions identify why customers choose to bank with one financial institution over another. Developed in conjunction with creative experience agency Monigle, the Humanizing Customer Experience research from American Banker draws on more than 5,000 customer responses to show what matters most in customer experience and ranks which financial institutions do it best. Join this discussion to learn more about how you can optimize your bank's approach to CX to improve customer satisfaction and earn higher net promoter scores.

-

Rising inflation and moves by the Federal Reserve are expected to fuel interest rate growth into 2022.

October 14 -

Also, Freddie Mac and Fannie Mae's securitization platform shuns private-label market, UniversalCIS and Credit Plus merge and Arizent research shows work remains to reach industry DEI goals.

October 8 -

But overall improvement in September employment numbers are likely to encourage the Federal Reserve to begin tapering their asset purchases.

October 8 -

Take our survey to share your views on how the market will develop in the coming year.

October 6 -

Also, forbearances fall below 3%, Incenter offers Ginnie Mae MSRs and Democrats introduce a 20-year mortgage option.

October 1 -

Residential starts rose 3.9% last month to a 1.62 million annualized rate after an upwardly revised July print, according to government data released Tuesday.

September 21 -

The builder was found guilty of stealing over $1 million from home buyers, lenders, businesses and a family member’s special needs trust between 2016 and 2020.

September 16 -

Residential construction was up 27% year over year in July, according to the U.S. Census Bureau.

September 3 -

Dave banking app originally created to do away with overdraft charges has taken the industry by storm. It's on a mission to advance financial opportunities for all Americans. Join Penny Crosman, Executive Editor of American Banker and Jason Wilk, CEO and Co-Founder of Dave as they talk about how this app is changing the way people manage their money and what’s in store for the future of one-stop-shops for finances.

-

The Federal Housing Finance Agency in the Trump administration had been preoccupied with Fannie Mae and Freddie Mac’s capital position. Acting Director Sandra Thompson has shifted the agency’s focus to affordable housing and fair lending.

August 27 -

The COVID-19 pandemic has exacerbated income inequality in America, and that has implications for banks and other lenders. Among those suffering most: renters, front-line workers and minority small-business owners.

August 23 -

Community banks have played and will continue to play a key role in supporting local economies across the country. Join us in a lively conversation with Dennis E. Nixon, President & CEO of International Bank of Commerce (Laredo, Texas) & Chairman, International Bancshares Corporation and Eddie Aldrete, Senior Vice President at International Bank of Commerce as we discuss: (1) the need for bankers and the business community to become involved in political issues. From minimum wage and issues that affect small businesses to regulatory issues that directly affect the banking industry, banking and business leaders need to be thought leaders in the public conversation and (2) how bankers can play a pivotal advocacy role in the free trade process.

-

This year's assessment for Fannie Mae and Freddie Mac is the first to take into account a January agreement between the Federal Housing Finance Agency and the Treasury Department that allowed the companies to retain more earnings.

August 13 -

The guarantor of mortgage-backed securities has been without a Senate-confirmed president for four and a half years. The vacancy makes it difficult for other government agencies to coordinate housing objectives, according to stakeholders.

August 12 -

The company’s $204 million in net income was down from unusual highs seen recently but still historically strong thanks to the balance between its loan channels and servicing operation, representatives said.

August 6 -

Increased purchase lending and added pressure from Fannie Mae and Freddie Mac’s new loan limits should drive the likelihood of borrower misrepresentation.

August 6 -

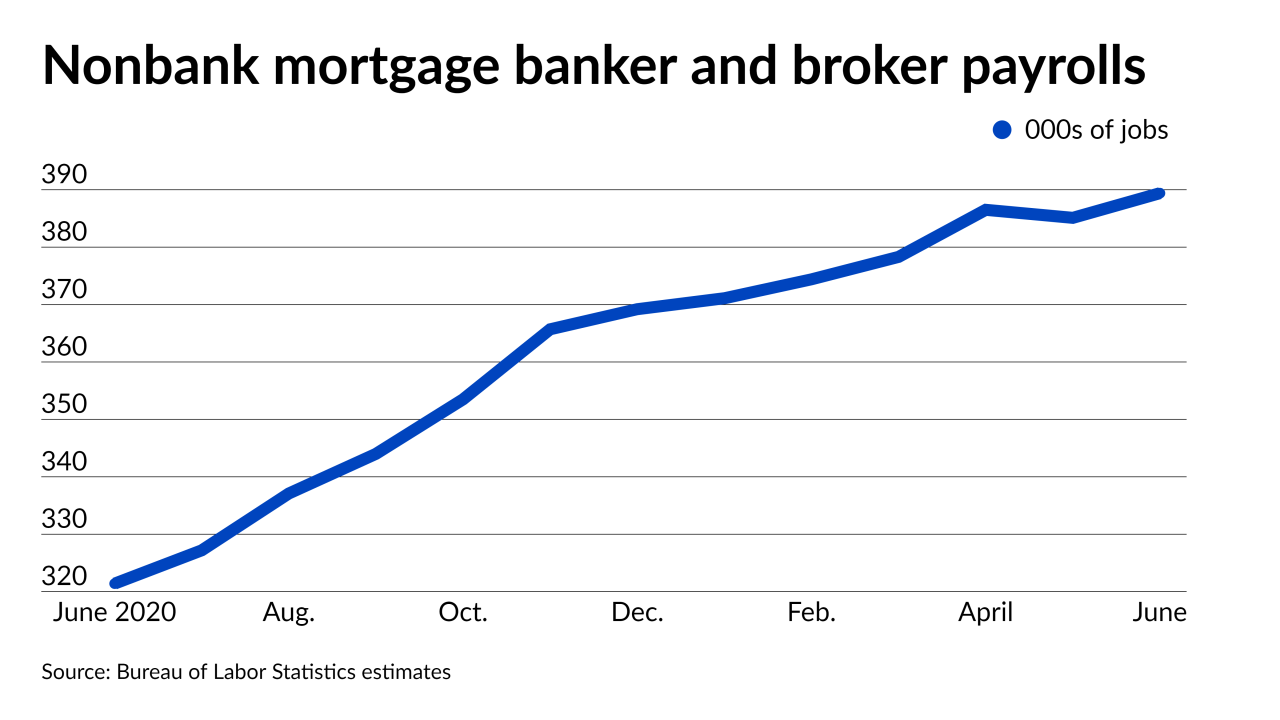

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

The hot hot real estate market has pulled homeowners out of a debt trap that many had been stuck in since the great financial crisis more than a decade earlier.

August 6 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3