-

Live Well Financial, a reverse and traditional mortgage lender that abruptly stopped originating on May 3, will lay off 103 employees, according to a Virginia Employment Commission filing.

May 7 -

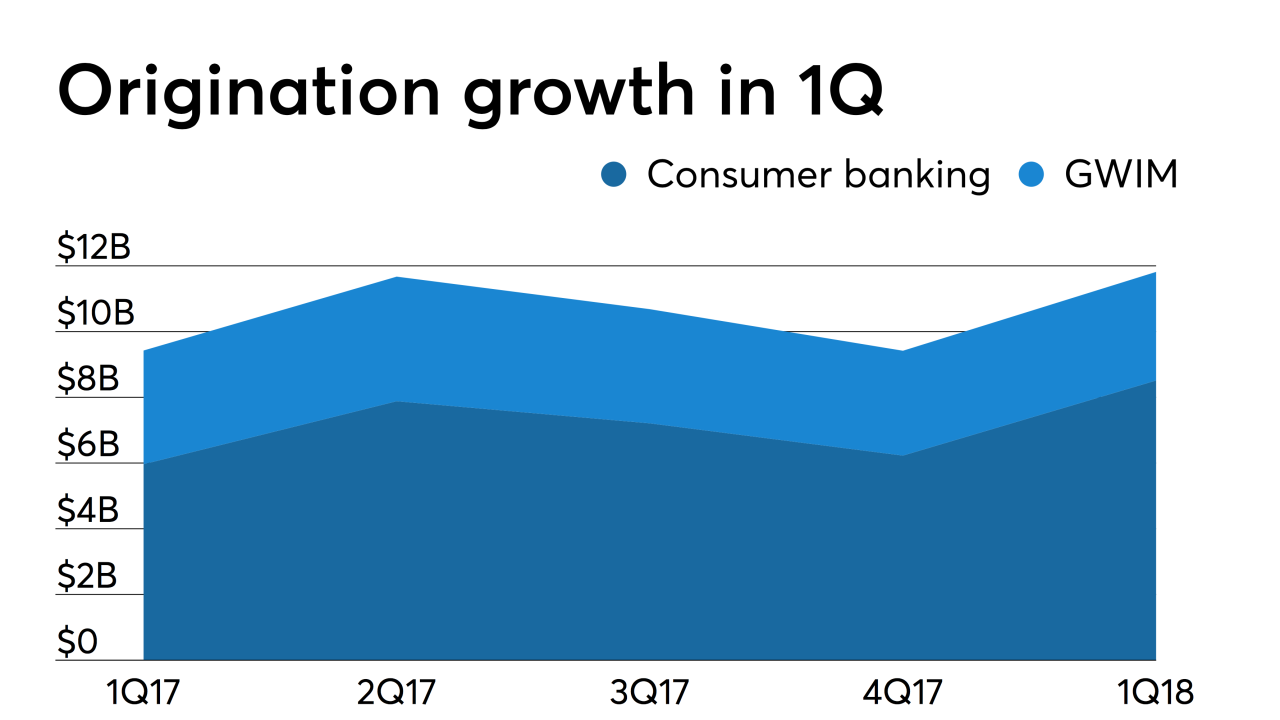

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16 -

Point, which provides an alternative to traditional home equity lending products, has raised $122 million in new capital from eight investors to expand its reach.

March 20 -

Home equity is at an all-time high, but consumers aren't taking advantage of this financing option, according to LendingTree.

March 19 -

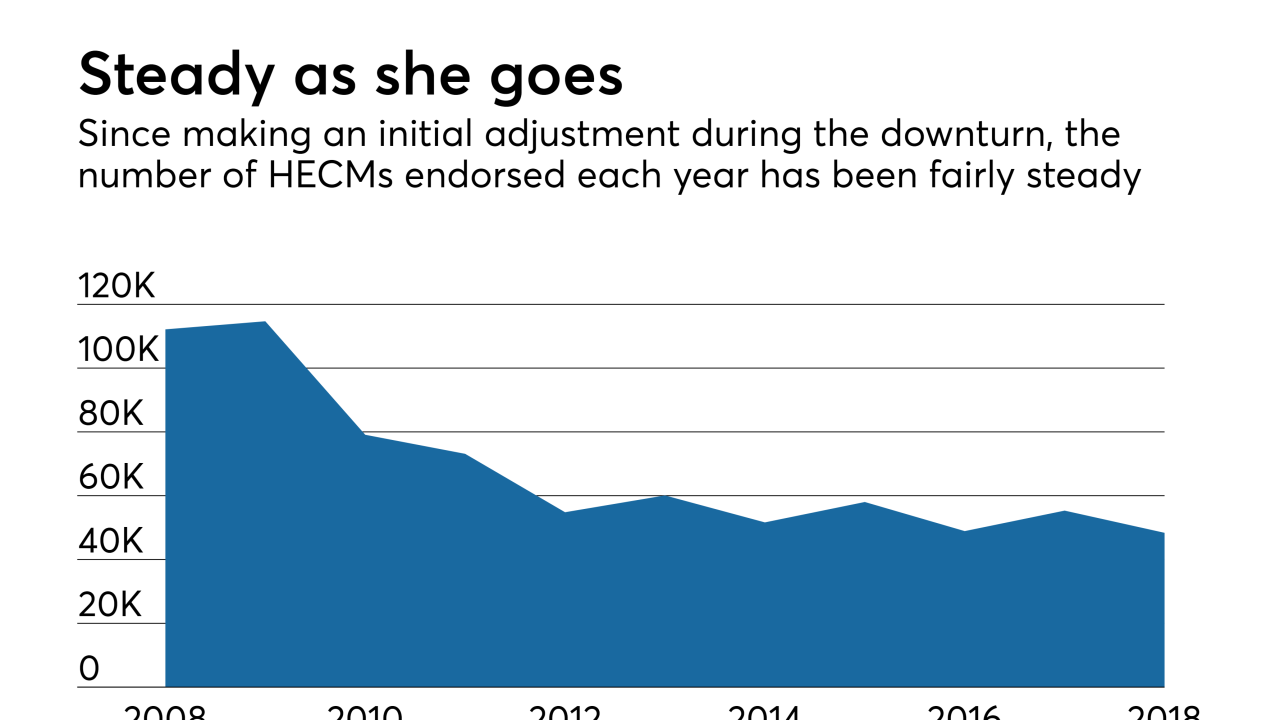

A pair of professors with industry ties say reverse mortgages deserve a second look, partly because of a series of federal reforms in recent years designed to protect taxpayers and consumers.

March 13 -

While millennials comprise the largest cohort of homebuyers, the aging baby boomer generation has created 7.86 million more homeowners and 2.82 million renters age 60 and older — growth rates higher than any other demographic.

March 4 -

Figure, the startup headed by Mike Cagney, uses blockchain technology to provide home equity loans in as little as five days. It intends to use the newly raised funds to offer other services, including wealth management.

February 27 -

Home equity loans the Federal Housing Administration offers to older borrowers are in a better position now that the government shutdown has temporarily ended.

January 28 -

Better Mortgage has launched a mortgage refinance program to help federal government employees affected by the shutdown utilize their home equity for living expenses.

January 18 -

Bank of America's first-mortgage production dropped almost 26% year-over-year in the fourth quarter of 2018, but it experienced a less severe 10% decline in home equity lending during the same period.

January 16 -

Consecutive-month default rates for home loans are increasing, and they could remain higher the next few months, according to a recent report.

January 15 -

Consumer lending should also be a bright spot, while mortgage lending could be suppressed by rising rates and tight housing supplies.

January 9 -

More consumers fell behind on their loans in the third quarter of 2018, even as average wages rose and the unemployment rate fell to a 50-year low.

January 8 -

Late payments on mortgages are expected to keep dropping and credit is expected to remain strong next year, in part because housing prices remain healthy in most areas, according to TransUnion.

December 13 -

Weakening prices from the most expensive metro areas caused the first decline in available equity since the market started recovering from the housing crisis, according to Black Knight.

December 10 -

Most millennials are purchasing fixer-uppers in order to afford a house, with 75% planning to finance renovations by tapping the equity in their home, according to a Chase Home Lending report conducted with Pinterest.

November 12 -

A notable drop in home equity lending at Bank of America during the third quarter contributed to an overall decline in new single-family loans produced by the company.

October 16 -

Mike Cagney’s current venture, Figure Technologies, is offering consumers the ability to apply online for home equity loans and get funding in as little as five days.

October 10 -

Finance of America Reverse is offering a new second-lien alternative to the Federal Housing Administration's Home Equity Conversion Mortgage that can be placed on a property with a pre-existing first-lien loan.

September 26 -

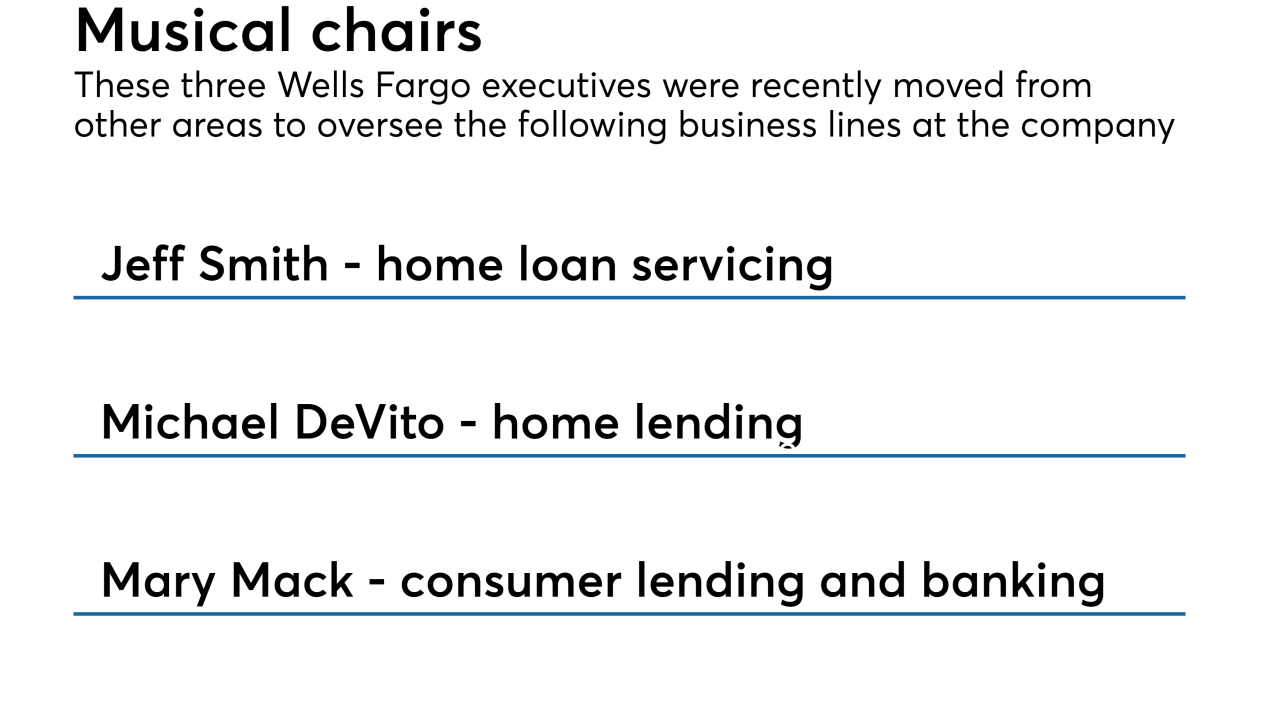

Wells Fargo has named Senior Vice President Jeff Smith to succeed Perry Hilzendeger as head of home loan servicing following Hilzendeger's earlier appointment to head of retail home lending.

July 26