-

Sales of previously owned homes remained brisk in August as low mortgage rates and demand for space in the suburbs sustained strength in a housing market that’s a bright spot for the economy.

September 22 -

The number of pending sales in Sonoma County, Calif., was up 27% from June through August 2020 versus the same period in 2019 and the percentage of properties that went off the market within two weeks was up 8% in the same period in 2020 versus 2019.

September 22 -

The song remains the same: There still aren't enough houses to keep up with all the people trying to buy them in Missoula, Mont., so that means prices keep shooting up.

September 22 -

The percentage of borrowers who have asked to temporarily suspend payments due to coronavirus-related hardships is down overall, but in the Ginnie Mae market, they're still inching up.

September 21 -

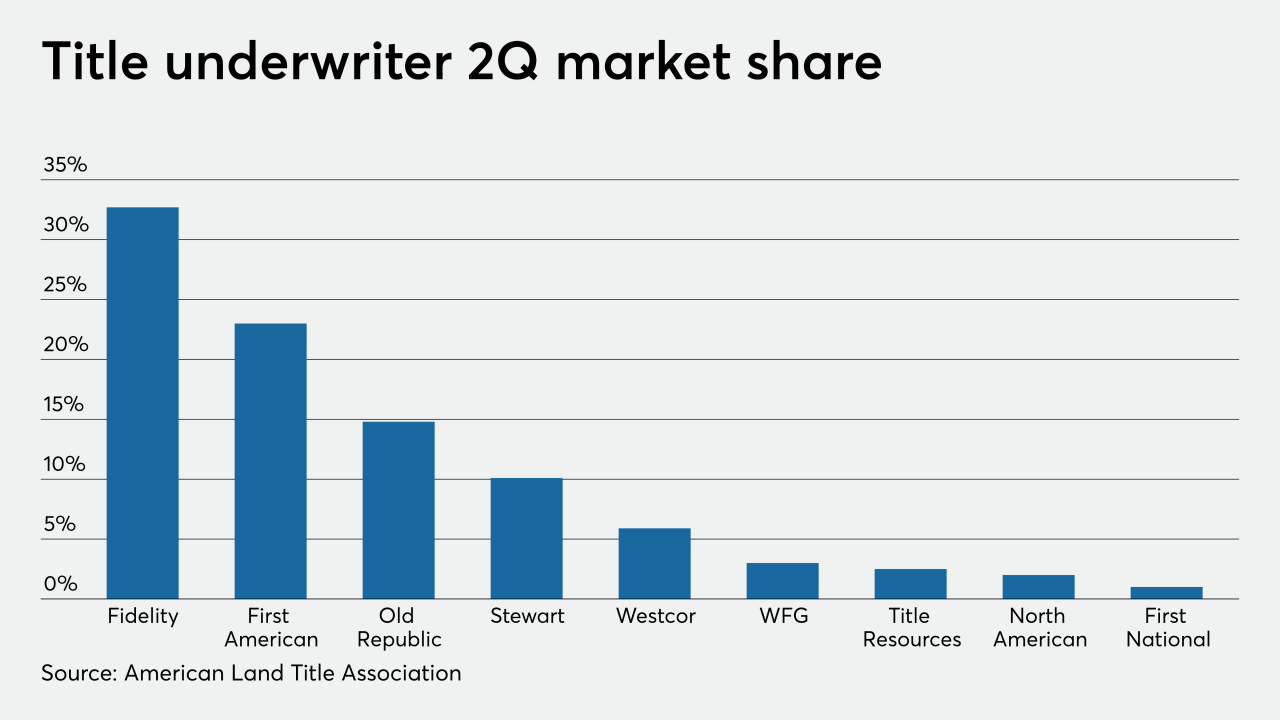

Westcor has been gaining market share, growing to 5.9% of premiums written in 2Q 2020, versus 3.4% in the first quarter of 2019.

September 21 - LIBOR

The restrictions on the pooling of loans with any interest term based on Libor will be effective for traditional mortgage-backed securities issued starting Jan. 21, 2021, and earlier for reverse-mortgage securitizations.

September 21 -

Canadian new home prices recorded their sharpest one-month gain in three years with higher demand and rising costs for building materials.

September 21 -

August was a blockbuster month for home sellers across the 16-county metro, despite the global pandemic and a coming presidential election, which typically puts buyers on edge.

September 21 -

Marin County, Calif., home sales jumped by 46% in August over the prior year, marking the third straight month of gains after the rocky pandemic spring.

September 21 -

Remote, homeowner-assisted appraisals used amid the coronavirus could be a useful tool post-pandemic, in limited circumstances.

September 18 -

Data security, while better than paper-based processes, still can be a problem, according to panelists at Digital Mortgage 2020.

September 18 -

Mortgage industry hiring and new job appointments for the week ending Sept. 18.

September 18 -

Although it moved from the glitz of Las Vegas to a fully virtual event, the 2020 Digital Mortgage Conference delivered insights and acumen from the industry.

September 17 -

The Flagstar MortgageTech Accelerator program was designed to give qualified fintechs access to experienced mentors and potential customers. Applicants also may obtain access to seed capital funding.

September 17 -

Home starts fell more than forecast in August, reflecting less construction of apartments and a decline in the tropical storm-hit South, representing a pause in momentum for a housing market that's been a key source of fuel for the economy.

September 17 -

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

September 17 -

Low rates, along with increased new and existing home sales activity drives the latest forecast.

September 16 -

Lenders and vendors are starting to realize that there are both areas in which artificial intelligence can be used more broadly, and areas in which technology’s role should be limited.

September 16 -

A deep understanding of the history of racial discrimination in both lending and technology is a prerequisite to the development of new technologies, panelists said.

September 16 -

The only rational strategy for holding MSRs is to be very aggressive on protecting the servicing assets via loan recapture. This is one of the chief reasons that banks have been willing to give up their share in lending and servicing as they collapse back to retail-only lending strategies.

September 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC