President Donald Trump's support of legislation that would cap credit card interest rates at 10% has flagged in recent weeks, but experts say that the debate has highlighted significant gaps in regulators' understanding of the credit card market and how its risks are priced.

The Mortgage Bankers Association's index of home-purchase applications rose 5.1% in the week ended Jan. 16, data from the group showed Wednesday.

Marshall is tasked with bringing Sagent's Dara servicing platform implementation up to scale, replacing Geno Paluso, who is vice chairman during the transition.

The partial US government shutdown is on track to end later Tuesday after the House passed a funding deal President Donald Trump negotiated with Senate Democrats, overcoming opposition from both ends of the political spectrum.

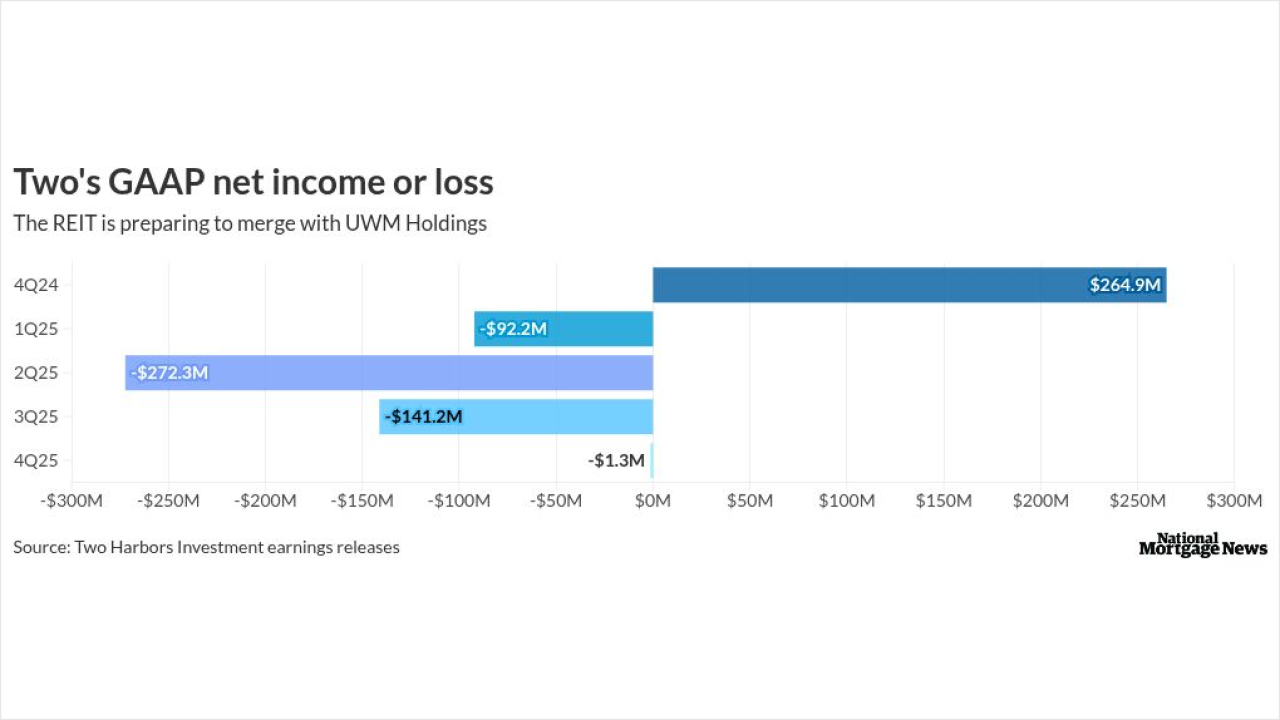

As measured by earnings available for distribution at the REIT, Two posted a profit of $0.26 per share but this was well below the consensus estimate of $0.37.

-

The SEC named Demetrios "Jim" Logothetis as chairman of the PCAOB, and Mark Calabria, Kyle Hauptman and Steven Laughton as board members.

-

The average homebuyer who purchased a home below the asking price last year received a 7.9% discount, the largest since 2012, Redfin found.

-

The mortgage lender will also conduct its own independent audit to determine if any further instances of unlicensed activity occurred after 2022.

-

The Senate-approved bill that hadn't yet cleared the House at the time of this writing would fund agencies like HUD through the end of the fiscal year.

-

Although investor properties, which are prone to higher chances of default, account for 58% of the pool, the strong borrower and collateral quality mitigate the credit stress.

-

Dan Sogorka is leaving Rocket to be with his family in San Diego, while Austin Niemiec's title is unchanged but he will no longer be responsible for retail.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

FICO's claims about its 10T score highlight how its monopoly has stifled innovation and raised costs for homebuyers, according to the CHLA's Rob Zimmer.

-

With comments on the proposed repeal due Sept. 26, stakeholders must demand decisions based on data — not politics, according to the founder of 480 Advisors.

-

VantageScore 4.0 is more predictive than Classic FICO, offering a measurable lift in identifying high-risk borrowers and avoiding losses, according to the chief data scientist at VantageScore.

Hint: It requires balancing technology with the appropriate degree of personalization and human interaction.

As home lending sees some of the lowest volumes in decades, the mortgage industry seeks to tap into emerging trends and ideas that will draw in future waves of clients.

- ON-DEMAND VIDEO

Recent economic data have shown inflation stubbornly above the Fed's 2% target, putting rate cuts in jeopardy. Lauren Saidel-Baker, an economist with ITR Economics, parses the FOMC meeting, Chair Powell's press conference and takes a look at future policy.

- ON-DEMAND VIDEO

D.A. Davidson Director of Wealth Management Research James Ragan will review and analyze the March Federal Open Market Committee meeting.

- ON-DEMAND VIDEO

Dan Snyder, CEO and co-founder of Lower discusses the state of the mortgage industry in 2024 and his experience of running a home lending business in past and current market conditions.

-

-

-

- Sponsor Content from ICE Mortgage Technology