Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Residential value growth in March reached heights not seen since the lead up to the housing bubble, according to CoreLogic.

May 4 -

An economic rebound, stimulus payments and COVID-19 vaccinations contributed to new delinquencies dropping to an all-time monthly low with more recovery ahead, according to Black Knight.

May 3 -

As consumers search for homebuying advantages, local lenders discuss the 12 metro areas where it’s more affordable to purchase a property rather than rent a comparable house, according to Realtor.com data.

April 30 -

Depressed Treasury yields have kept mortgage rates under 3% recently, but positive economic news could indicate larger increases will follow this week’s uptick.

April 29 -

After a one-week reprieve, mortgage activity waned again with decreased demand for refinances and extremely low inventory for homebuyers.

April 28 -

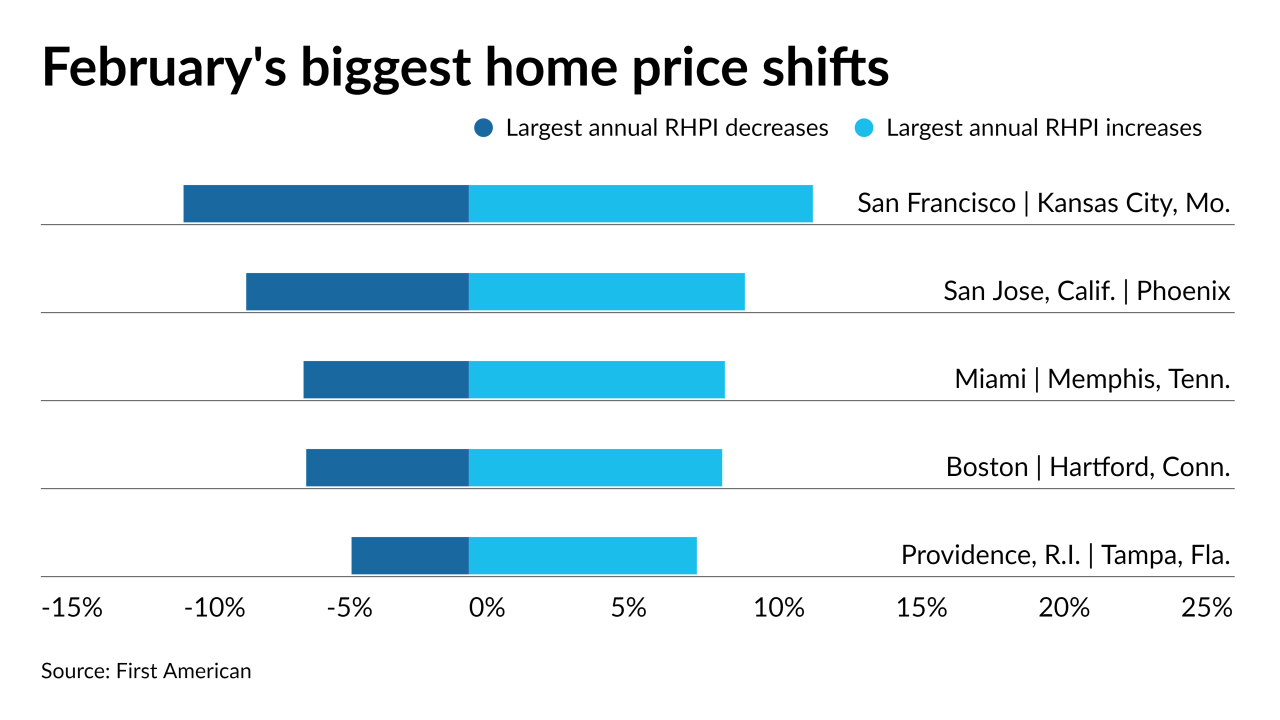

Despite home purchasing power growing for the 14th consecutive month in February, rising property values and mortgage rates are likely to influence would-be sellers to stay put, according to First American.

April 27 -

Despite falling from quarter to quarter, Flagstar’s mortgage revenues remained strong, while its servicing portfolio grew.

April 26 -

While government protections currently shield most borrowers and delay process timelines, a growing backlog is likely to hit some areas of the country worse than others.

April 23 -

While it’s the third straight week of a downward trend, borrowers likely have only a brief opportunity to take advantage of sub-3% rates before a reversal comes.

April 22 -

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21 -

At the metro level, Buffalo, N.Y., had the worst undervaluation for Black-owned homes at 86% followed by 72% in both Memphis, Tenn., and Indianapolis, Redfin found.

April 20 -

As listings were snagged at near-record speed, inventory hit yet another new low point, according to Remax.

April 19 -

And with demand far outweighing supply, the average new-home purchase loan ascended to another record high.

April 15 -

COVID-19 quickly altered the hierarchy of borrower debt, with home financing payments taking precedence over credit cards and auto loans, according to TransUnion.

April 14 -

In the nonstop deluge of loan volume, last year’ highest producing loan officers leaned on tech — though sometimes reluctantly — to adapt in the digital marketplace.

April 14 -

While the overall delinquency rate decreased for the fifth straight month, states with unemployment rates that were double and triple the national average had the most overdue loans, a CoreLogic report found.

April 13 -

The stabilizing economy drove one of the biggest mortgage recoveries on record, according to the Mortgage Bankers Association.

April 12 -

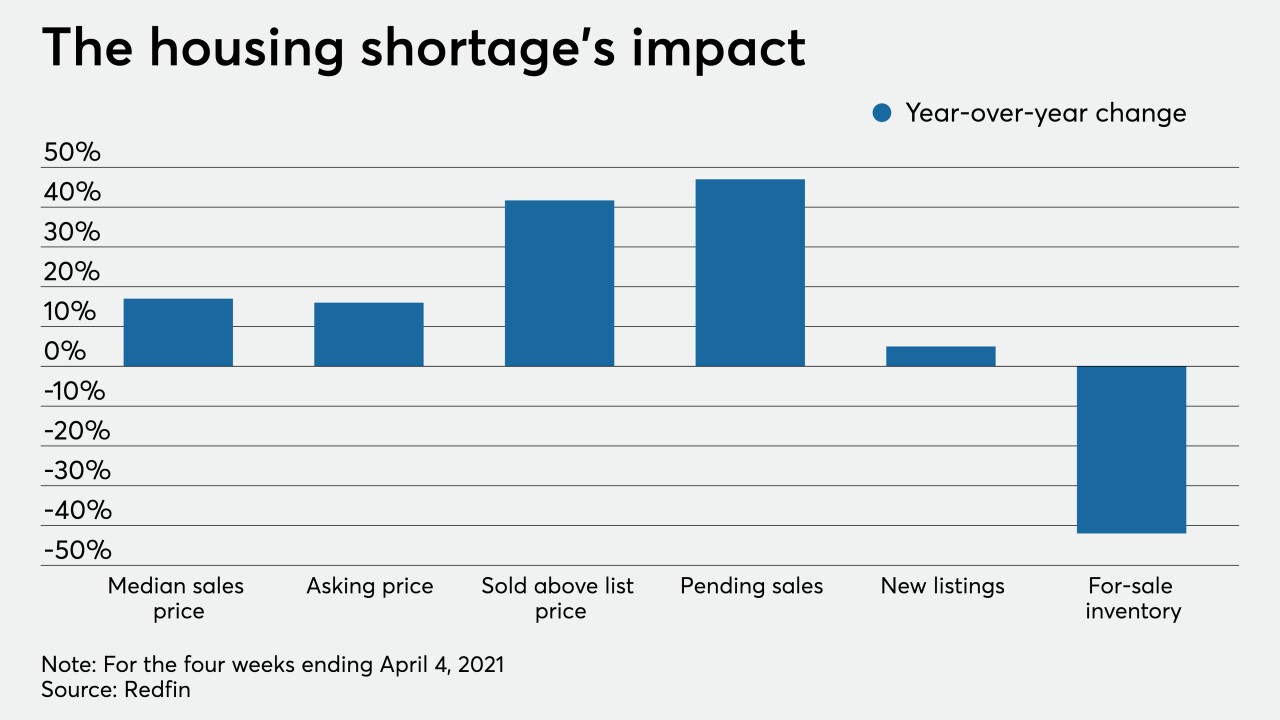

Even as properties spent the least time ever on the market and the average sale-to-list home price ratio broke 100%, some indicators point to a slight reversal, which could head off “runaway home price speculation or a housing bubble,” Redfin chief economist Daryl Fairweather said.

April 9 -

The digital lender’s valuation ballooned to $6 billion from $4 billion less than five months after closing a $200 million fundraise.

April 8 -

More lenders are willing to take on borrowers who are lower on the qualification spectrum as the economy rebounds.

April 8