-

And an uptick from second-quarter numbers is attributed to seasonality rather than any upswing in the economy.

November 3 -

Getting ahead of the next wave of mortgage fraud calls for rock-solid systems with several protective tools deployed at once. But that only goes so far without the proper employee preparation.

November 3 -

The forbearance rate improved to the a level not seen since early April, but getting back to pre-COVID levels will require employment gains or additional government stimulus measures, according to the Mortgage Bankers Association.

November 2 -

Meanwhile, the delinquency rate is up 89% year-over-year, according to Black Knight.

November 2 -

But both fell short under the Duty to Serve goals in rural housing.

November 2 -

A Democratic victory in Tuesday's election would likely produce new leaders at the CFPB and OCC who could take bank regulation in a sharply different direction. Here are some names potentially under consideration.

November 2 -

The technology rolled out by the Department of Housing and Urban Development aims to provide lenders with immediate and expanded responses related to Federal Housing Administration insurance eligibility.

November 2 -

Two investors pushing CoreLogic Inc. to explore a sale won partial support from a prominent shareholder advisory firm, which urged shareholders to support three of the dissident group’s nominees for the board.

November 2 -

Also: Fannie Mae announces imminent implementation of hedge accounting.

October 30 -

The origination boom generated another profit for the company in the third quarter, when also it obtained a novel source of liquidity to support its servicing operations.

October 30 -

The agency’s final rule modernizing the Fair Debt Collection Practice Act limits calls to seven per week, but collectors won stronger protections from liability claims and other key changes to the original proposal.

October 30 -

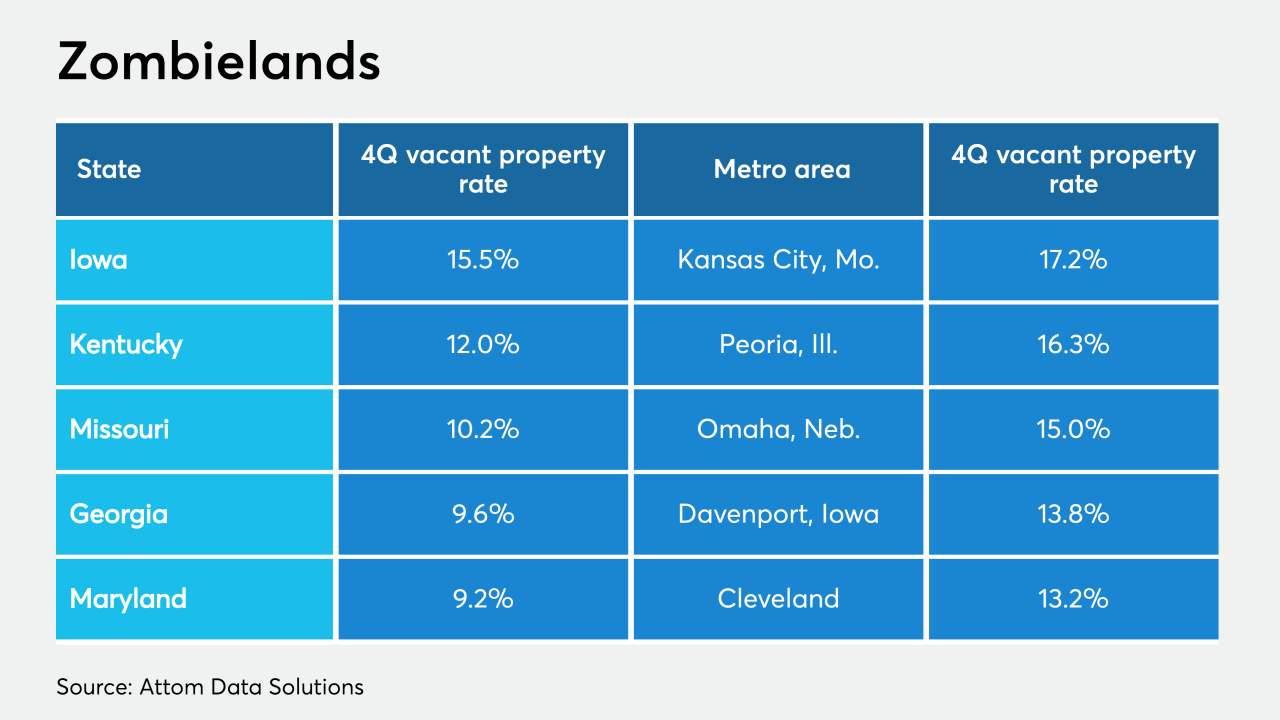

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

The digital bank is on a larger mission to attract younger customers. It's inserting itself into the popular video game in the hope that game players will learn about its products and have fun at the same time.

October 30 -

How we resolve millions of delinquent mortgages due to COVID is the only question that matters.

October 30 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Four tranches of AAA-rated notes in the $342.2 million JPMorgan Mortgage Trust 2020-8 may utilize a term-SOFR rate should the benchmark improve on the weighted-average coupon of the deal.

October 29 -

The upcoming shift may help to prepare the government-sponsored enterprise for a conservatorship exit by reducing interest-rate volatility in Fannie’s earnings.

October 29 -

The government-sponsored enterprise also saw a 22% increase in net worth from the second quarter.

October 29 -

The proposed regulation would codify a 2018 pronouncement by regulators that guidance does not carry the force of law.

October 29 -

A gauge of pending home sales unexpectedly declined in September for the first time in five months, a sign elevated asking prices and lean supply are tempering the boom in housing despite the record-low interest rates.

October 29 -

The Assistant Secretary for Housing and Federal Housing Commissioner at the Department of Housing and Urban Development says HUD is removing regulatory barriers to the proliferation of manufactured housing.

October 29 Department of Housing and Urban Development

Department of Housing and Urban Development