-

The company expects to get between $17 and $19 per share.

October 15 -

The agreement with Florida ends the saga that began in April 2017, when several states sued the company. However, the CFPB's case filed at the same time remains active.

October 15 -

Innovation is key in today's dynamic market. Suni Harford, president, asset management at UBS walks us through two significant innovations she drove in the asset management industry this year — including a ground-breaking approach to climate change and sustainable investing.

October 15 -

While spiking from the year before, mortgage applications to purchase new homes fell in September from August, with low supply and high unemployment keeping it in check, according to the Mortgage Bankers Association.

October 15 -

The Buffalo, N.Y., bank will pay a $546,000 penalty, which will be passed on to the National Flood Insurance Program to help offset costs.

October 15 -

Just a week after commenting that the bottom on mortgage rates was possibly reached, Freddie Mac reported that they fell 6 basis points to another record low.

October 15 -

Lower-than-expected rates will drive mortgage production this year, but they’ll have less of an impact in 2021.

October 14 -

A surge of mortgage originations allowed Ginnie Mae to surpass its high watermark for mortgage-backed security issuance by nearly 33%.

October 14 -

California house sales will rebound slightly next year from the pandemic, and home prices will continue edging upward, thanks to rock-bottom mortgage rates and strong homeownership demand, according to the California Association of Realtors.

October 14 -

CEO Charlie Scharf disappointed investors by failing to provide either a detailed road map for long-term expense reductions or say when he might release such a plan.

October 14 -

One could change how commercial property is taxed, the other could change rent control policies. Both might affect financing.

October 14 -

Mortgage applications decreased 0.7% from one week earlier, but lending activity should continue strong for the remainder of the year as rates stay low, according to the Mortgage Bankers Association.

October 14 -

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

The agency had raised concerns in the Obama administration about kickbacks in the marketing pacts between mortgage lenders and other providers, but the agency's recent guidance says the deals are legally viable.

October 9 -

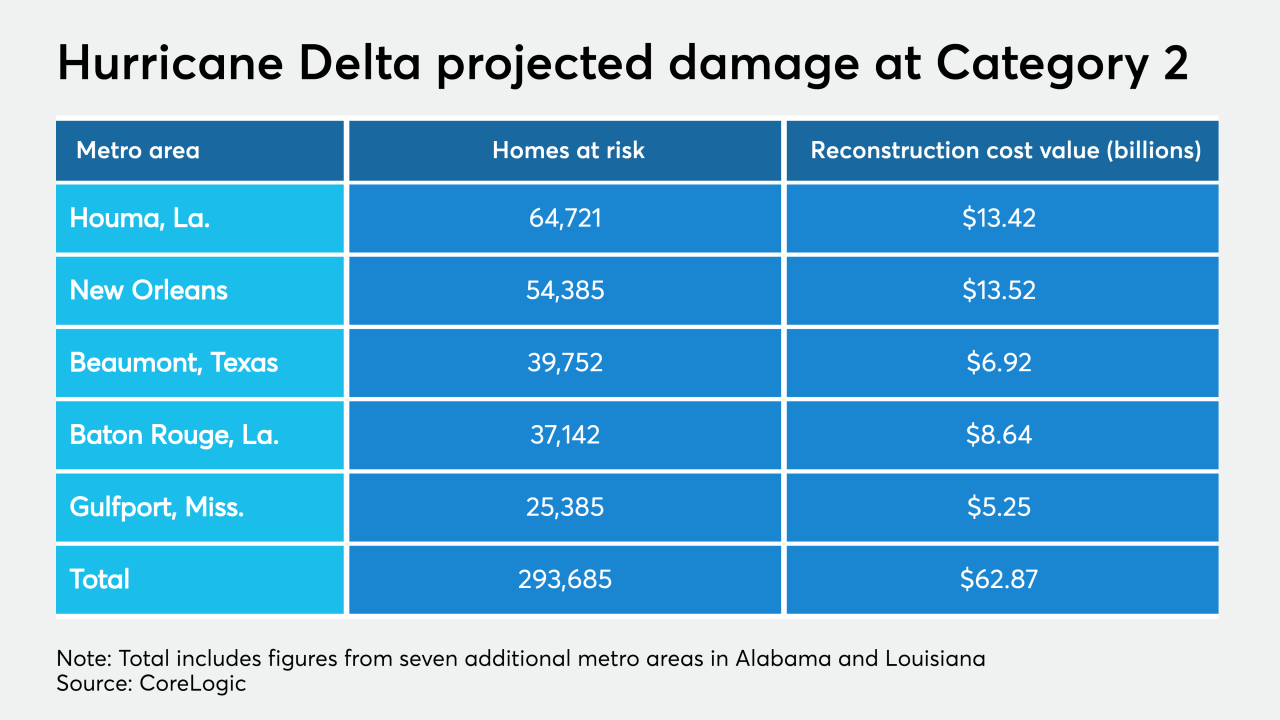

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

The expanded relief on tax income data will become accessible this fall, according to a press release LoanBeam issued this week during Freddie Mac's Connect client conference.

October 9 -

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

The metro areas surrounding New York, Washington, Philadelphia and Baltimore face the highest risk of impact from the pandemic based on home affordability, equity and foreclosures.

October 8 -

The government-sponsored enterprises set a Sept. 30 deadline for sellers to accept applications for Libor adjustable-rate mortgages.

October 8