-

Mortgage rates remained flat this week, a sign that the bottom has possibly been reached, but the housing market looks to remain strong for the near future, according to Freddie Mac.

October 8 -

The company says it plans to originate 40,000 mortgages for Black and Hispanic households and finance 100,000 affordable rental units over five years.

October 8 -

Millennials continue to lock in the lowest average mortgage rates on record, keeping lenders busy and the housing market churning, according to Ellie Mae.

October 7 -

But overall sentiment as measured by Fannie Mae continued to recover from the depths of this spring.

October 7 -

The up-and-down pattern for mortgage application activity continued, as volume rose 4.6% from one week earlier led by refinancings, according to the Mortgage Bankers Association.

October 7 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

HSBC, Bank of the West and Fannie Mae are among those offering green mortgage bonds, financing commercial clients’ efforts to rein in carbon emissions and developing other novel products that help customers tackle environmental challenges.

October 6 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

But most borrowers who have exited forbearance plans are back on track when it comes to paying, and the incidence of loss mitigation plans is high among those who aren't.

October 5 -

If the tally included loans with some form of payment relief, the rate would be close to 8%.

October 5 -

The notes are backed by $456.9 million in high-balance loans that meet qualified mortgage standards, according to ratings agency presale reports.

October 5 -

Kroll's $2 million settlement with the SEC over failing to adhere to credit-rating standards for CMBS and CLO bonds are fueling concerns that rosy credit grades are masking deeper structural problems with the securities exposed by COVID-19 related stresses, say critics.

October 5 -

Two more lenders, AmeriHome and Caliber, look to join Rocket and United Wholesale Mortgage, by raising capital through public stock offerings.

October 2 -

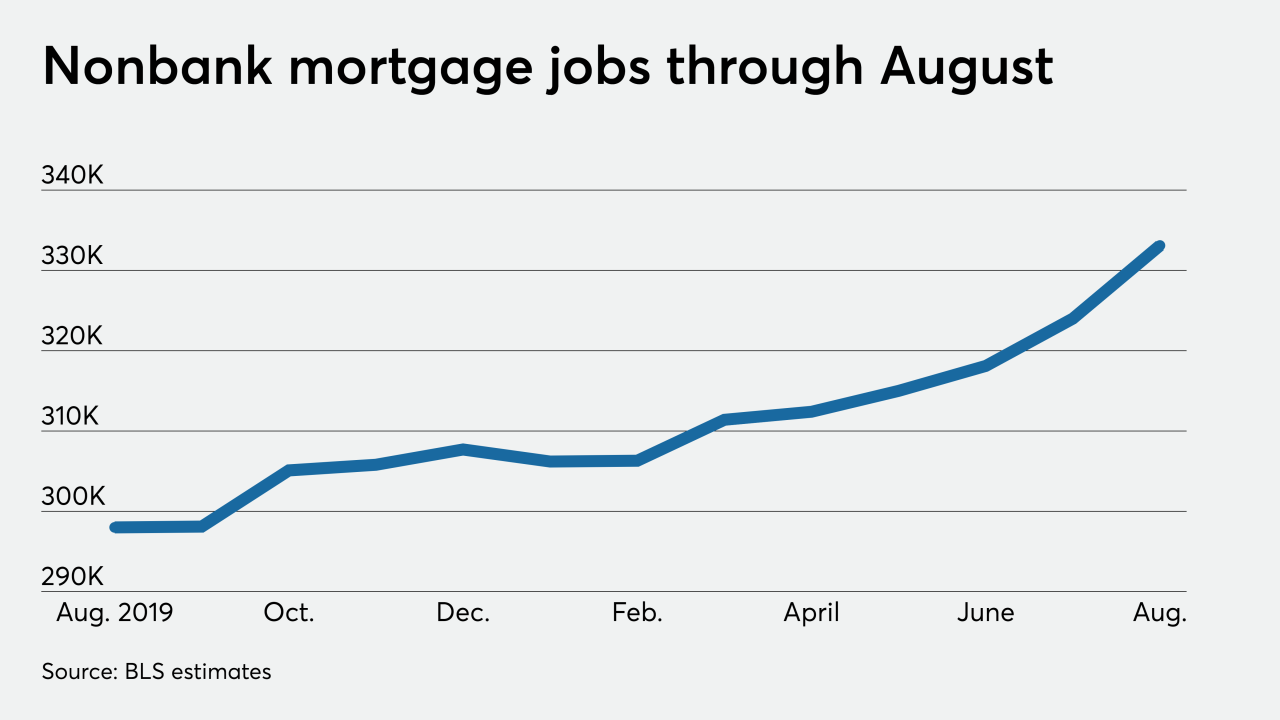

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

Kathy Kraninger’s job status would be in question if Joe Biden wins the White House. If the president is reelected, she may continue balancing a deregulatory agenda with her unexpectedly tough stance on enforcement.

October 2 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

Control of the U.S. Senate hangs in the balance in the upcoming election, with the outcome determining the direction of laws and regulations that can have a profound impact on financial services, technology, fintech and payments innovation.

October 2 -

With the onset of COVID and the reaction by the Federal Reserve Board and other agencies, market pressures have reduced credit availability significantly.

October 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The bar to prove discriminatory patterns is so high that plaintiffs would have slim odds of winning lawsuits against housing providers.

October 2 George Washington University

George Washington University -

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

October 1