-

A new marketing tool lets consumers start the mortgage prequalification process by sending a text message, providing would-be borrowers with credit and loan program details and offering lenders a low-cost source of leads.

January 3 -

With its bolstered fundraising cache, the Mortgage Bankers Association Political Action Committee should hold an increased influence over the industry's policy and regulation issues in the coming year.

January 2 -

Adjustable-rate mortgages in November had their highest share of closed loans since Ellie Mae started tracking this data in 2011 as rates for 30-year loans reached 5.15%.

December 19 -

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13 -

Growing home prices and climbing interest rates didn't stop millennials from buying houses in October, Ellie Mae said.

December 5 -

Average credit scores for mortgage borrowers remain at a 2018 high, a sign that lenders aren't easing standards despite refinance candidates already falling off on higher rates, according to Ellie Mae.

November 21 -

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

As interest rates rise, mortgage originators need to teach millennial homebuyers about the product options outside of conventional loans, Ellie Mae said.

November 14 -

Mortgage industry executives claim sparse affordable housing supply is the most impactful hurdle for first-time homebuyers entering the market in 2019, but the majority don't think regulatory policy will help the cause.

November 6 -

Mortgage borrower credit scores hit their low points more than five months after making a home purchase, but lender reporting cycles also cause these results to vary, according to LendingTree.

October 31 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

August's share of conventional mortgages closed by millennials reached a three-year high as lenders added products to meet their lifestyle, Ellie Mae said.

October 3 -

When it comes to attracting millennials, mortgages could be the key to capturing this demographic for the long haul – provided CUs are willing to put in the work.

September 26 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

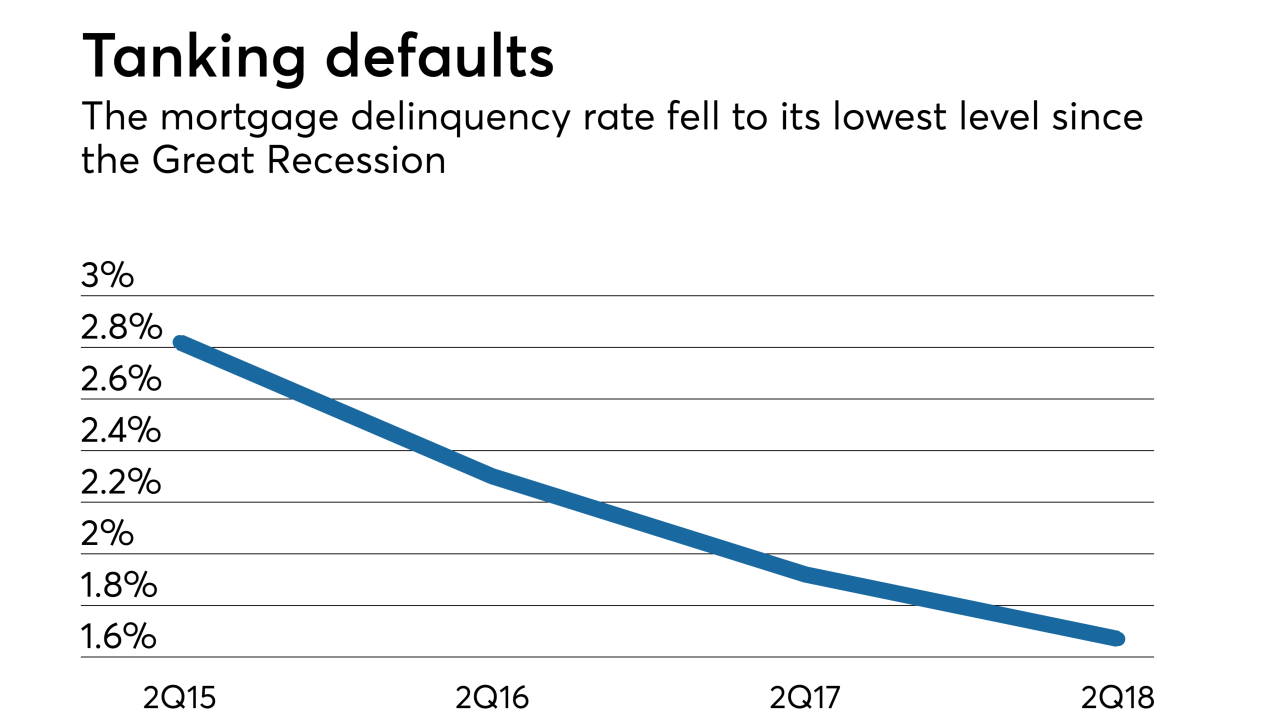

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22 -

Credit Karma is diving into the mortgage industry with a plan to acquire digital mortgage startup Approved, a provider of consumer-facing online point of sale technology.

August 17 -

The number of consumers being pursued by debt-collection agencies fell dramatically in the past year, but it's as much technicality as achievement, and bankers need to keep that in mind when reviewing the credit scores of millions of Americans.

August 14 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1