The House Financial Services Committee passed a legislative package heavily favored by banks in a 26-16 vote

There's a 13-percentage-point differential in the use of "advanced" mortgage fraud detection tools between banks and non-banks, with costs as a major reason why.

New limits on trigger leads push originators toward first-party data, past customers and referral networks as they rethink how to reach borrowers.

The sector has specialized data that experts can help with and may mitigate cyclical risk, but costs and customers are considerations, an industry veteran says.

This year 40 companies had what it takes to land on the Best Mortgage Companies to Work For list.

The top employers in home lending value business partners with a large market share and reach but they also need to differentiate themselves.

-

Applications for renovation financing in 2024 were more abundant in some of the nation's smaller counties and states, than in the largest housing markets.

-

The housing supply gap hit an estimated 4.03 million, an increase from 3.8 million in 2024, as new construction fell short again, according to Realtor.com.

-

Mutual of Omaha, Finance of America and Longbridge Financial rank at the top of HECM endorsements over the past 12 months, Reverse Market Insight reported.

-

A US hedge fund is said to hold about £200 million ($268 million) of mortgage-backed facilities tied to the failed UK company and has declined comment.

-

Sens. Tim Scott, R-S.C., and Elizabeth Warren, D-Mass., released new legislative language Monday night that includes a ban on institutional investors' purchase of single family homes and a temporary ban on the Federal Reserve issuing a Central Bank Digital Currency.

-

While two employees say they were never repaid for a $200,000 loan to the struggling lender, the CEO says the pair broke their promise to cover business losses.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Despite a weak ADP jobs print, Treasury yields went nowhere, reinforcing a growing bearish, defensive case for rates, according to the CEO of IF Securities.

-

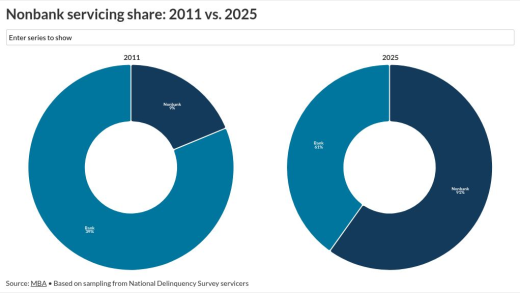

IMBs outperform banks, face outsized scrutiny, and confront rising affordability challenges, according to the President of the Community Home Lenders of America.

-

Stop chasing digital leads and invest in face-to-face partnerships that build trust and referrals sustainable growth, writes a leader of Choice Mortgage Group.

- ON-DEMAND VIDEO

The Federal Open Market Committee will meet on June 17-18. While no rate cuts are expected at this point, things can change quickly. Lauren Saidel-Baker, economist at ITR Economics, provides her take on the meeting the new Summary of Economic Projections and Fed Chair Jerome Powell's press conference.

- ON-DEMAND VIDEO

Get expert analysis of the May FOMC meeting, inflation outlook, and Powell's comments.

- ON-DEMAND VIDEO

Mike Goosay, Chief Investment Officer of Global Fixed Income at Principal Asset Management, breaks down the Federal Open Market Committee meeting, Chair Powell's press conference and the SEP.