Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

By tracking remote workers with customizable benchmarks, Grind Analytics’ new software tool increased efficiency for one of its first users, OneTrust Home Loans.

January 26 -

The subsidiary of New Residential Investment produced nearly $400 million in non-QM volume in the first quarter of 2020 before putting a hold on the product offering in March.

January 25 -

The uptick follows the pandemic-era trend of midmonth increases in active plans, according to Black Knight.

January 22 -

Appointee Jenn Jones spent the last four years as the chief of policy and membership at the National Community Reinvestment Coalition, an organization fighting housing and lending discrimination.

January 21 -

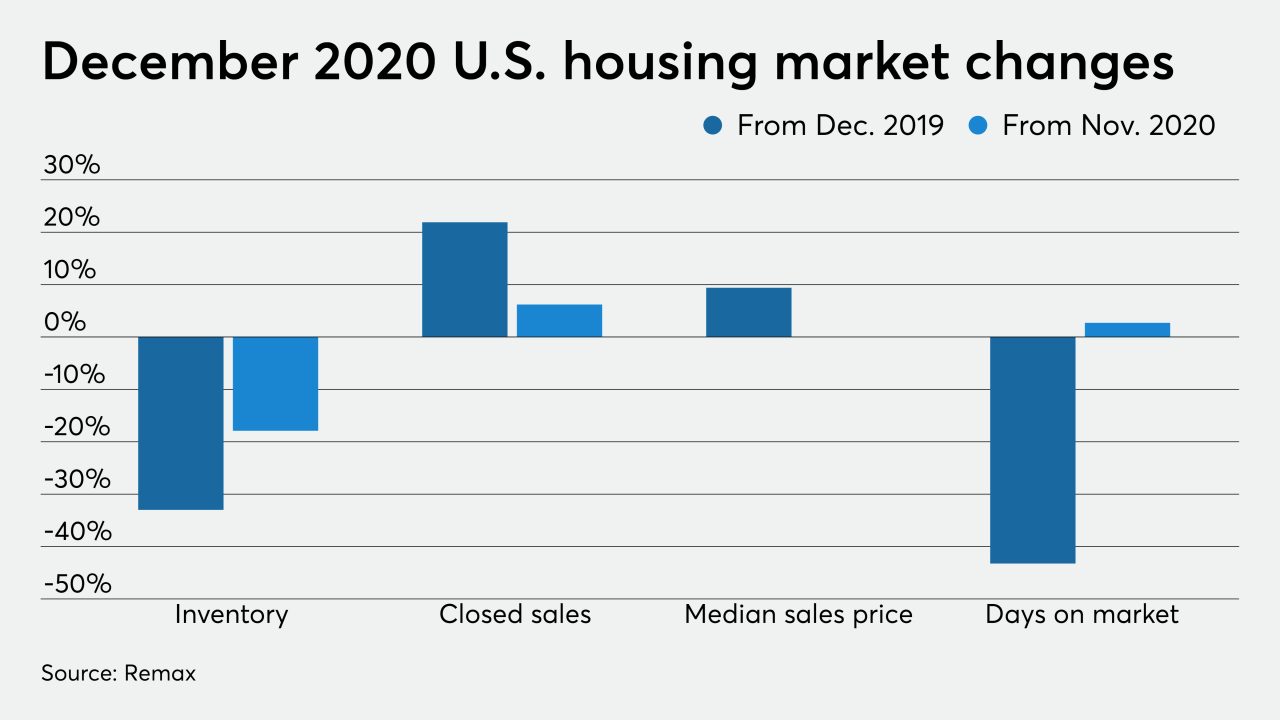

Bottomed-out mortgage rates cut listing times and housing inventory while sales volume and average prices jumped annually.

January 19 -

With refinance volumes predicted to fall — but currently continuing apace — lenders explain how they’re readying themselves for eventual contraction and its implications for their expenditures.

January 19 -

Despite mortgage rates expected to rise modestly in 2021, a bolstered Biden administration stimulus package and COVID-19 vaccination efforts bring promise for economic recovery.

January 15 -

While the annual total marks a 16-year low, the numbers are likely to change dramatically once government moratoria expire, according to Attom Data Solutions.

January 14 -

The software will aim to take advantage of the anticipated volume growth in this particular type of origination.

January 14 -

After doubling its valuation in five months, Blend plans to use its latest funding to strengthen its digital lending experiences for banking and mortgages.

January 13 -

While distressed mortgage rates continued the fall’s short-term slide, serious delinquencies are three times higher than the year-ago total, according to CoreLogic.

January 12 -

The deal will add to SitusAMC’s tech suite, making the connection between loan originators and lenders more efficient.

January 11 -

A slowdown in the increase of loans exiting forbearance “implies that those who were able to absorb the shock of the pandemic and get back on their feet, may have already done so,” said Andy Walden, Black Knight economist.

January 8 -

December’s housing market sentiment hit a seven-month low, indicating that inventory could be further constrained by sellers waiting for a better time to list, according to Fannie Mae.

January 7 -

As housing and lending companies try to eradicate racism and bias from their industries, automated valuation tools could help reach that goal, according to the American Enterprise Institute.

January 5 -

With limited plan removals due to the holidays, mortgages in coronavirus-related forbearance rose by 15,000, according to Black Knight.

January 4 -

Remote online notarization helped originators close loans amid social distancing measures, but complex local laws remain a barrier to its widespread use.

December 30 -

The agency's request for input will shape how mortgages underwritten by Fannie Mae and Freddie Mac handle appraisals and curb risk.

December 29 -

Despite intensified demand and plummeting inventory, consumer home purchasing power made gains behind falling interest rates in October, according to First American.

December 28 -

High property value growth can be locked in through proximity to one of the top amenities an area can have: grocery stores.

December 23