-

The agency’s final rule modernizing the Fair Debt Collection Practice Act limits calls to seven per week, but collectors won stronger protections from liability claims and other key changes to the original proposal.

October 30 -

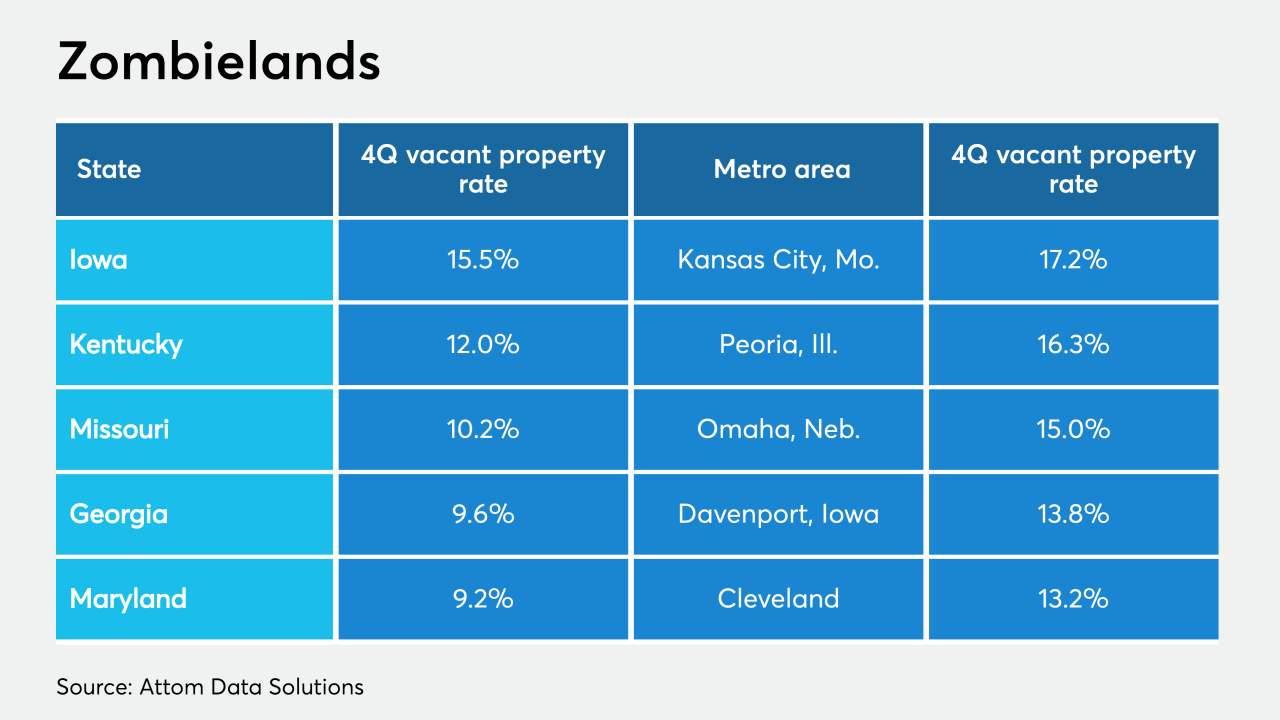

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

The digital bank is on a larger mission to attract younger customers. It's inserting itself into the popular video game in the hope that game players will learn about its products and have fun at the same time.

October 30 -

How we resolve millions of delinquent mortgages due to COVID is the only question that matters.

October 30 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Four tranches of AAA-rated notes in the $342.2 million JPMorgan Mortgage Trust 2020-8 may utilize a term-SOFR rate should the benchmark improve on the weighted-average coupon of the deal.

October 29 -

The upcoming shift may help to prepare the government-sponsored enterprise for a conservatorship exit by reducing interest-rate volatility in Fannie’s earnings.

October 29 -

The government-sponsored enterprise also saw a 22% increase in net worth from the second quarter.

October 29 -

The proposed regulation would codify a 2018 pronouncement by regulators that guidance does not carry the force of law.

October 29 -

A gauge of pending home sales unexpectedly declined in September for the first time in five months, a sign elevated asking prices and lean supply are tempering the boom in housing despite the record-low interest rates.

October 29 -

The Assistant Secretary for Housing and Federal Housing Commissioner at the Department of Housing and Urban Development says HUD is removing regulatory barriers to the proliferation of manufactured housing.

October 29 Department of Housing and Urban Development

Department of Housing and Urban Development -

Mortgage rates remained relatively flat this week, helping housing to stay as one of the bright spots in the U.S. economy during the current uncertainty, according to Freddie Mac.

October 29 -

Researchers are increasingly focused on the risks related to owner-occupied loans with low balances and low-income properties with a limited number of renters.

October 29 -

The scheme targeted distressed homeowners in the Filipino community, most of whom were nonnative English speakers, forcing some of them into bankruptcy and homelessness, according to law enforcement officials.

October 29 -

The company said it is "engaging with third parties" that are reportedly willing to pay at least $14 per share more than Senator Investment and Cannae Holdings.

October 28 -

But for the first time in a month, fewer consumers refinanced into a government-guaranteed mortgage.

October 28 -

The agency found a 40% error rate in the 2016 data submitted by the Seattle bank. In addition to the fine, the institution is required to improve its compliance systems.

October 27 -

The agency finalized a rule to determine which party in a loan sale is subject to regulatory requirements. Advocates charged that the move will help predatory lenders.

October 27 -

A 2019 decision by Amy Coney Barrett, then a 7th Circuit judge, cited an earlier Supreme Court ruling suggesting a high bar for plaintiffs to claim harm. But other jurists have favored a less onerous standard.

October 27 -

The final consent order contained the largest penalty, for $1.8 million to be paid by Low VA Rates. In total, the CFPB has issued $4.4 million in fines for such marketing of VA loans.

October 27 -

U.S. home prices rose the most in two years in August as low mortgage rates spurred competition for an increasingly scarce supply of listings.

October 27