-

The CEOs of Fannie Mae and Freddie Mac are stepping down because the job they were hired to do — return the GSEs to profitability — is done. But attracting top-flight candidates to lead the mortgage giants into a new phase may not be easy.

September 24 -

The central bank said the proposal is intended to eliminate duplication of rules for entities covered by the Secure and Fair Enforcement for Mortgage Licensing Act of 2008.

September 21 -

The deadline for mortgage lenders and servicers to sign up to participate in NMN's inaugural Best Mortgage Companies to Work For survey and rankings is Friday, Sept. 21.

September 20 -

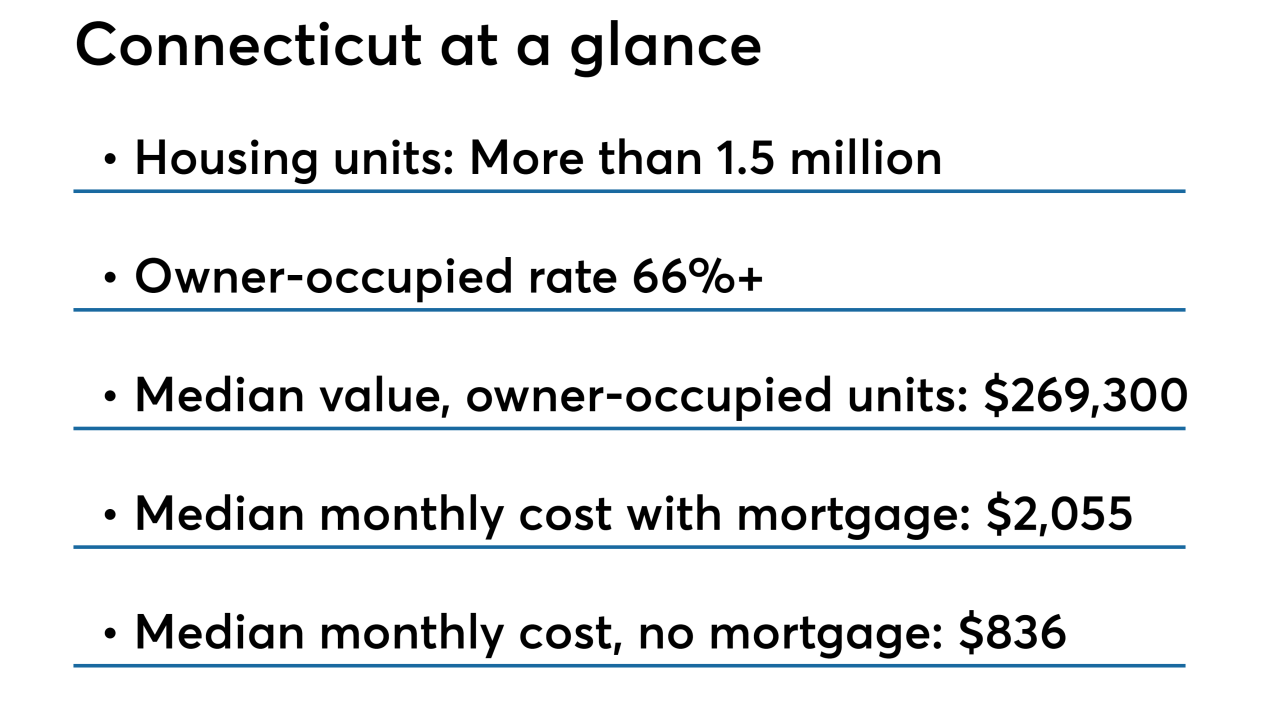

1st Alliance Lending plans to cut up to 35 employees in Connecticut and terminate efforts to expand its East Hartford headquarters in order to prepare for an expected increase in regulatory costs.

September 19 -

Mortgage applications were up 1.6% from one week earlier, marking only the second increase of the past two months despite key interest rates rising, according to the Mortgage Bankers Association.

September 19 -

The bank pared down its application to 50 questions and allows customers to do the easy work before turning it to the loan officer.

September 18 -

The migration to digital may change the way loan officers work, but it won't make them less essential: BofA Consumer Lending SVP John Schleck.

September 18 -

An AI-powered virtual assistant could be used in a variety of ways, including helping customers to prequalify for mortgages, easing compliance and detecting problems.

September 18 -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

While new-home construction and sales should rise in the next 18 months, next year's mortgage origination volume estimate was cut slightly as the economy is expected to slow down soon, said Fannie Mae.

September 17 -

Increased sales of lower-priced newly built homes was not enough to counter a decline in mortgage application volume for the segment in August, according to the Mortgage Bankers Association.

September 14 -

Mortgage industry hiring and new job appointments for the week ending Sept. 14.

September 14 -

New Penn Financial has launched a condo loan program that features more flexible property restrictions than what's allowed under Fannie Mae and Freddie Mac guidelines.

September 13 -

Mortgage origination volume continues to decline as homebuyers receiving loans bring more money to the closing table.

September 13 -

Stearns Lending is buying large equity stakes in smaller mortgage banking companies as it looks to grow its retail loan production business.

September 12 -

Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

September 12 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

From origination to servicing and everything in between, here's a sneak peek at the companies and products presenting demos at the 2018 Digital Mortgage Conference.

September 10 -

Mortgage industry hiring and new job appointments for the week ending Sept. 7.

September 7 -

Mortgage applications decreased 0.1% from one week earlier, dropping for the seventh time in eight weeks even with scant movement in interest rates, according to the Mortgage Bankers Association.

September 5