-

A significant percentage of consumers are willing to turn to technology companies for their financial needs, including applying for a mortgage, although they have trust issues with them, a Fannie Mae report said.

February 5 -

The New York Department of Financial Services disapproved the merger between Fidelity National Financial and Stewart Information Services, regulatory filings from both title insurance underwriters said.

February 4 -

Some hopeful souls in Washington believe the commercial banking industry will return to originating and servicing higher-risk mortgages, but most banks are more likely to continue withdrawing from the sector.

January 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

With its new round of funding, the mortgage fintech company will look to expand its geographic reach and reduce the mortgage closing process to a week in 2019.

January 29 -

The same TILA-RESPA integrated disclosure errors continue to plague mortgage lenders, though those documents have been required for over three years, a report from MetaSource said.

January 29 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

Adjustable-rate mortgages for the second consecutive month hit a post-crisis high, due to strong demand for housing being constrained by a lack of supply, according to Ellie Mae.

January 24 -

Rising mortgage rates will only be "a mild deterrent" to home purchase activity during 2019 as other indicators like price and demand will cancel that out, according to Standard & Poor's.

January 23 -

Fannie Mae and Freddie Mac are adding another round of new underwriting requirements and a workaround for employment verification in response to the prolonged government shutdown.

January 17 -

Radian and Essent will make their "black box" mortgage insurance pricing methods live on Jan. 21, leaving MGIC as the only company yet to announce its adoption.

January 14 -

Home prices are expected to increase in 2019, but there is little chance for a bust because the typical warning signs a bubble is forming aren't evident, a report from Arch MI said.

January 11 -

The government shutdown could affect mortgage origination credit quality as lenders miss some red flags normally found using data that is not currently available, according to Moody's.

January 10 -

The standards for mortgage lending constrained in December, as a drop in conventional credit brought availability to its lowest point since February 2017, according to the Mortgage Bankers Association.

January 10 -

Borrowers and financial institutions may be feeling the strain from reduced operations at the FHA and IRS, which has suspended the release of certain income documentation during the budget impasse.

January 4 -

The single-family rental market could benefit from more consistent loan terms and expanded secondary mortgage market opportunities, Freddie Mac found in a preliminary test of expanded involvement in the sector.

December 28 -

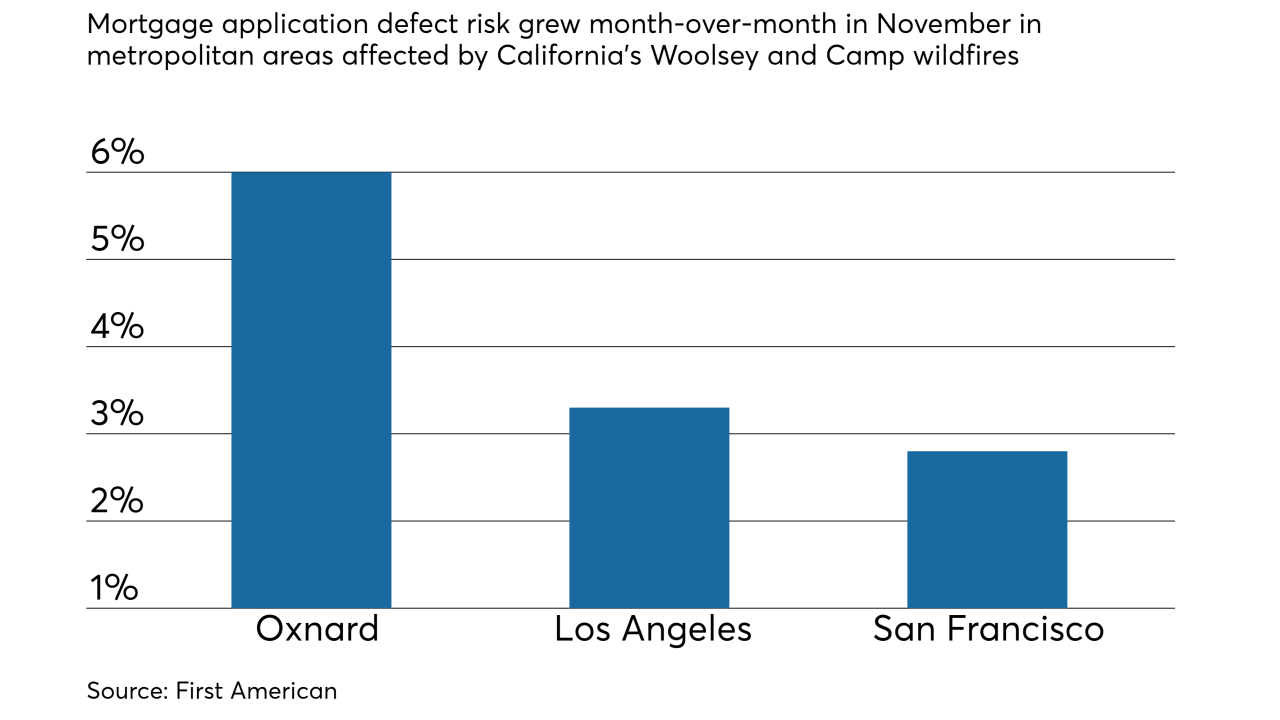

Mortgage application fraud risk continued growing for the fifth consecutive month, and the recent California wildfires are partly to blame, according to First American Financial Corp.

December 27 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21 -

Adjustable-rate mortgages in November had their highest share of closed loans since Ellie Mae started tracking this data in 2011 as rates for 30-year loans reached 5.15%.

December 19 -

Online competition has threatened brick-and-mortar retail, but as holiday shopping surveys this year show, certain businesses in the sector are still attractive to consumers and commercial mortgage lenders.

December 17