Excess cash flow will pay timely interest and protect against realized losses in the rated certificates before being paid out to the class X notes.

But attorneys for the small Chicago-based mortgage company remained defiant and actually welcomed the Bureau's move.

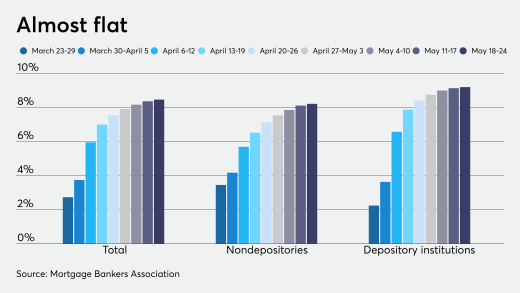

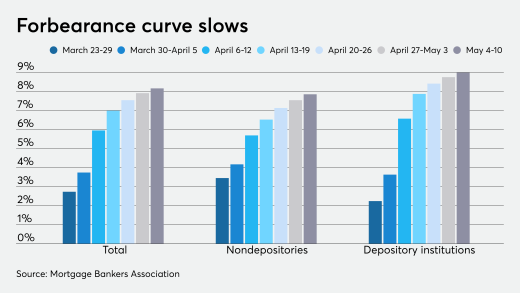

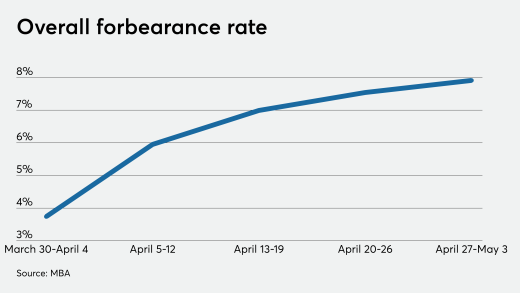

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

Supreme Court rulings and provisions in the recently passed budget bill are bolstering the legality of the administration's effort to fire more than 1,000 employees at the Consumer Financial Protection Bureau.

The VA Home Loan Program Reform Act arrives after the expiration of a previous foreclosure-prevention program sent foreclosure numbers spiking this spring.

-

Bessent reiterated his interpretation of the decline being mainly a product of deleveraging, saying he had no evidence that sovereigns were behind the drop.

-

The re-engineering of the convertible note arrangement between the two parties includes a one-time cash payment of $110 million by Better.

-

Federal Reserve Board member Christopher Waller said he would not be deterred from classifying inflation as "transitory" despite the board's recent experience underestimating inflationary pressures.

-

Cross 2025-H3 has moderate leverage, according to KBRA, with a weighted average (WA) loan-to-value ratio of 72.3%, and a debt-to-income ratio of 33.5%.

-

Omeed Malik, who runs a merchant bank and a hedge fund, is a Republican donor and works with Republican-linked businessmen including Donald Trump Jr.

-

The Buffalo, New York-based bank also said Monday that the commercial real estate lending market has started showing signs of life, but that the renewed competition is crimping its loan growth.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Optimum has a little twist involving its celebrity endorser.

-

Several industry solution providers have led the pack in advancing the quality and availability of mortgage data, analytics and compliance.

-

We're hearing that some in the mortgage industry are finding recent legal developments are further complicating and even potentially changing business decisions involving sales of nonperforming loans from the private-label residential mortgage-backed securities market.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland